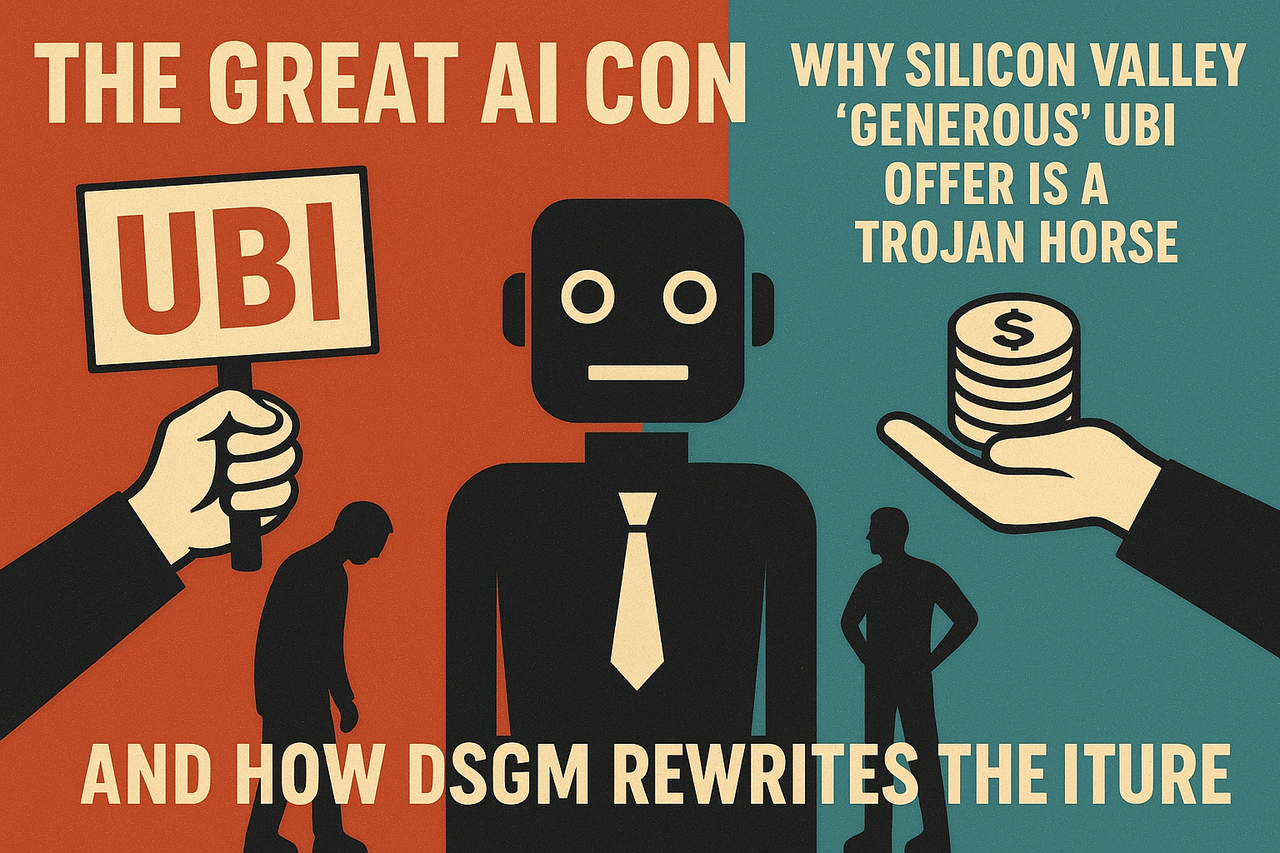

The Great AI Con: Why Silicon Valley’s "Generous" UBI Offer is a Trojan Horse (And What They’re REALLY Afraid Of)

Published in Economics and Law, Politics & International Studies

As artificial intelligence (AI) systems mature into powerful engines of economic disruption, a seductive narrative has emerged from Silicon Valley: Universal Basic Income (UBI), generously offered by the very corporations responsible for mass layoffs, will ensure that displaced workers remain fed, clothed, and placated.

This paper argues that corporate-promoted UBI is not a humanitarian safeguard but a Trojan horse: a tool of control designed to consolidate power, preserve monopolies, and forestall systemic reform. Far from a bold economic innovation, UBI as framed by AI corporations risks entrenching digital feudalism, reducing citizens to passive consumers in a corporate-controlled ecosystem.

In contrast, the Digital Sustainable Growth Model (DSGM) offers a structural alternative. By embedding revenue and governance directly into the digital economy itself, DSGM transforms AI from an extractor of wealth into a public utility that strengthens democracy, reduces global debt, and restores human agency.

The choice is stark: accept UBI’s gilded cage or build a system of shared prosperity through DSGM.

1. The UBI Mirage: Corporate Philanthropy as Social Control

1.1 Manufactured Obsolescence

AI-driven automation is displacing white-collar, service, and even creative work at a pace once thought impossible. Yet the same companies orchestrating this wave of obsolescence now propose to “rescue” society with stipends. This is not philanthropy. It is containment.

1.2 Economic Sleight of Hand

UBI’s fiscal math collapses on contact with reality. At ~$60 trillion annually to provide even a modest stipend globally, funding UBI would require unprecedented taxation. Proposals to tax corporate profits are politically charming but operationally naïve: Big Tech already weaponizes tax havens, offshore shell networks, and blockchain arbitrage to shield revenue. The likely fallback? Government debt monetization, accelerating an already unsustainable $235 trillion global debt spiral.

1.3 The Social Pacifier

UBI promotes subsistence, not empowerment. Its implicit message is chilling: You are no longer needed. Take your allowance and exit history quietly. Rather than encouraging human creativity or civic contribution, UBI risks producing a society of idle dependents — politically passive, economically constrained, and culturally atrophied.

1.4 Dependency as Domination

He who pays controls. If UBI is underwritten (directly or indirectly) by the AI corporations themselves, then dissenters face an unspoken threat: algorithmic exclusion. Speak against the system, and your lifeline can vanish. This is not freedom; it is the digital leash of a new aristocracy.

2. Why UBI Serves Corporate Interests

UBI is not neutral policy. It functions as a corporate risk management strategy:

-

Preserve demand: Even if workers are laid off, stipends keep them consuming within platform ecosystems.

-

Deflect regulation: By posturing as benevolent, corporations reduce pressure for structural reform.

-

Prevent systemic redesign: UBI assumes displacement is inevitable, foreclosing alternatives like human-AI collaboration or structural economic innovation.

-

Concentrate legitimacy: Tech giants become not just employers but welfare states, wielding unprecedented influence over society.

UBI is not a liberation tool. It is a stabilizer for monopoly capitalism in the AI age.

3. Enter DSGM: A Structural Counterproposal

Unlike UBI’s reactive pacification, the Digital Sustainable Growth Model (DSGM) re-engineers the foundations of the digital economy. It operationalizes three critical shifts:

3.1 Data as Public Value

Today, corporations harvest personal data without compensation. DSGM flips the equation: citizens own their data. Data becomes a currency, a continuously circulating source of value. Every interaction — social, commercial, creative — contributes to a shared dividend.

3.2 Automated Debt Resolution and Sustainable Investment

At the core of DSGM is a publicly owned AI platform (BankRabbna) that automatically channels the wealth generated by AI into debt resolution and sustainable projects. Global debt burdens shrink; capital is redirected toward green energy, healthcare, education, and infrastructure. The vicious cycle of extraction and austerity gives way to a virtuous cycle of shared reinvestment.

3.3 Human-AI Symbiosis

Where corporate UBI resigns humans to redundancy, DSGM makes humans indispensable. AI systems (branded Artificial Humanity in the DSGM framework) serve as co-pilots, handling computation while humans direct creativity, ethics, and strategy. Communities organize innovation networks, pairing AI’s scale with human ingenuity to solve collective crises.

4. The Political Stakes: Democracy vs. Digital Feudalism

The contrast could not be sharper:

-

UBI World (2035): Millions subsist on stipends. Corporate welfare states dominate political discourse. Governments are fiscally paralyzed by debt. Citizens are consumers, not participants.

-

DSGM World (2035): Citizens hold stakes in the digital economy. Debt is contained, global inequity reduced. AI serves as a transparent public utility. Communities innovate alongside AI rather than being displaced by it.

The question is whether the digital economy will be governed as a commons or a monopoly.

5. Anticipating Criticisms

-

“DSGM is too complex.” True systemic change always is. Embedding taxation and governance into digital infrastructure requires global coordination, but so did the creation of central banking, the internet, and the WTO. Complexity is not an excuse for feudalism.

-

“UBI ensures stability.” Stability at the price of agency is not sustainability. A pacified population is not a flourishing society.

-

“Corporate-led solutions are faster.” Speed without legitimacy breeds backlash. Sustainable reform requires public legitimacy, not corporate expedience.

6. Conclusion: A Call to Reclaim the Future

UBI as offered by Silicon Valley is not a solution to automation. It is a smokescreen, a strategy to preserve monopoly power under the guise of generosity. It reduces humans to passive dependents while AI corporations consolidate their role as the new sovereigns of a digital empire.

DSGM offers a radically different horizon: one where data is democratized, debt is dissolved, and AI is shackled to serve public purpose rather than corporate profit. It is not a utopia. It is not easy. But it is the only path to true socioeconomic sustainability in the AI age.

The choice is not theoretical. It is imminent. Humanity must decide whether to accept the digital pacifier of UBI or to build the democratic infrastructure of DSGM.

The robots are coming. The question is not whether they replace us — but whether we choose to feed them… or lead them.

References:

- Shalaby, A. The end of labor economics as we know it: DSGM and the shift to a 3D economy- a case study of Denmark’s transformation into a talent stock market. Digit. Econ. Sustain. Dev. 3, 17 (2025). https://doi.org/10.1007/s44265-025-00066-5

- Shalaby, A. (2024a). New Model for Digital Sustainable Growth: Insights from Human Biology and Surgical Approach – A Retrospective Analysis of 15 Years of Socio-Economic Innovations at the Human Information Technology Lab, Finland. DESD, 2, 14. DOI: 1007/s44265-024-00038-1

- Shalaby, Ahmed, The 2D Economy Is a Dead Horse-The Digital Sustainable Growth Model is Disrupting the Traditional Macro-Microeconomics in the 3D Economy (February 03, 2025). Available at http://dx.doi.org/10.2139/ssrn.5160079

- Shalaby, A. (2024b). Digital Sustainable Growth Model (DSGM): Achieving Synergy Between Economy and Technology to Mitigate AGI Risks and Address Global Debt Challenges. Journal of Economy and Technology. Available online 16 August 2024. DOI: 1016/j.ject.2024.08.003

- Shalaby, A. (2024c). Classification for Digital and Cognitive AI Hazards: Urgent Call to Establish Automated Safe Standards for Protecting Young Human Minds. DESD, 2, 17. DOI: 1007/s44265-024-00042-5

- Shalaby, A. (2024d). Leveraging the Digital Sustainable Growth Model (DSGM) to Drive Economic Growth: Transforming Innovation Uncertainty into Scalable Technology. Journal of Economy and Technology. DOI: 1016/j.ject.2024.09.003

- Shalaby, A. (2024e). Moving Beyond the Old Economic Models – A Response to Daron Acemoglu’s ‘The Simple Macroeconomics of AI’. SSRN: https://ssrn.com/abstract=5077217

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in