The landscape of the quantum start-up ecosystem

Published in Physics

The second quantum revolution has been producing groundbreaking scientific and technological outputs since the early 2000s, however, there has been a sort of 'gold rush' [1] since the mid-2010s, and with the amount of realized or promised public funding reaching almost $30b by 2022 [2], commercialization of QT is quickly becoming not just a set of emerging technologies but of emerging new markets.

In this paper, we present a landscaping study with a gathered dataset of 441 companies from 42 countries that we identify as quantum start-ups and answer the following questions: (1) What are the temporal and geographical distributions of the quantum start-ups? (2) How can we categorize them, and how are these categories populated? (3) Are there any patterns that we can derive from empirical data on trends? We found that more than 92% of these companies have been founded within the last 10 years, and more than 50% of them are located in the US, the UK, and Canada. We categorized the QT start-ups into six fields: (i) complementary technologies, (ii) quantum computing (hardware), (iii) quantum computing (software/application/simulation), (iv) quantum cryptography/communication, (v) quantum sensing and metrology, and (vi) supporting companies, and analyzed the population of each field both for countries, and temporally. Finally, we argue that low levels of quantum start-up activity in a country might be an indicator of a national initiative to be adopted afterwards, which later sees both an increase in the number of start-ups, and a diversification of activity in different QT fields.

We advise the readers of our paper to take our findings with a grain of salt, as we discussed in our limitations section, our dataset (although highly representative) is not a complete list of quantum start-ups due to the emerging nature of the field. Furthermore, the definition of which start-ups can be accounted as 'quantum' depends partially on personal taste. A company dealing with quantum chemistry simulations that run on classical computers is not a quantum start-up, however, if they are also simultaneously exploring whether their simulations can run on quantum computers, then we counted them as such. This is particularly complicated when it comes to quantum sensing, where single photon detection devices such as SNSPDs and APDs have already been utilized by the established sensing industry before the emergence of QT markets and with the increased amount of funding, some companies just rebranded their work as 'quantum' sensing. Similarly, SQUIDs (superconducting quantum interference devices) have been around for the last half a century and they are generally accepted as an output of the first quantum revolution (similar to the transistor), meanwhile, there have been many improvements and an expansion of their potential applications with the recent wave of funding towards QT.

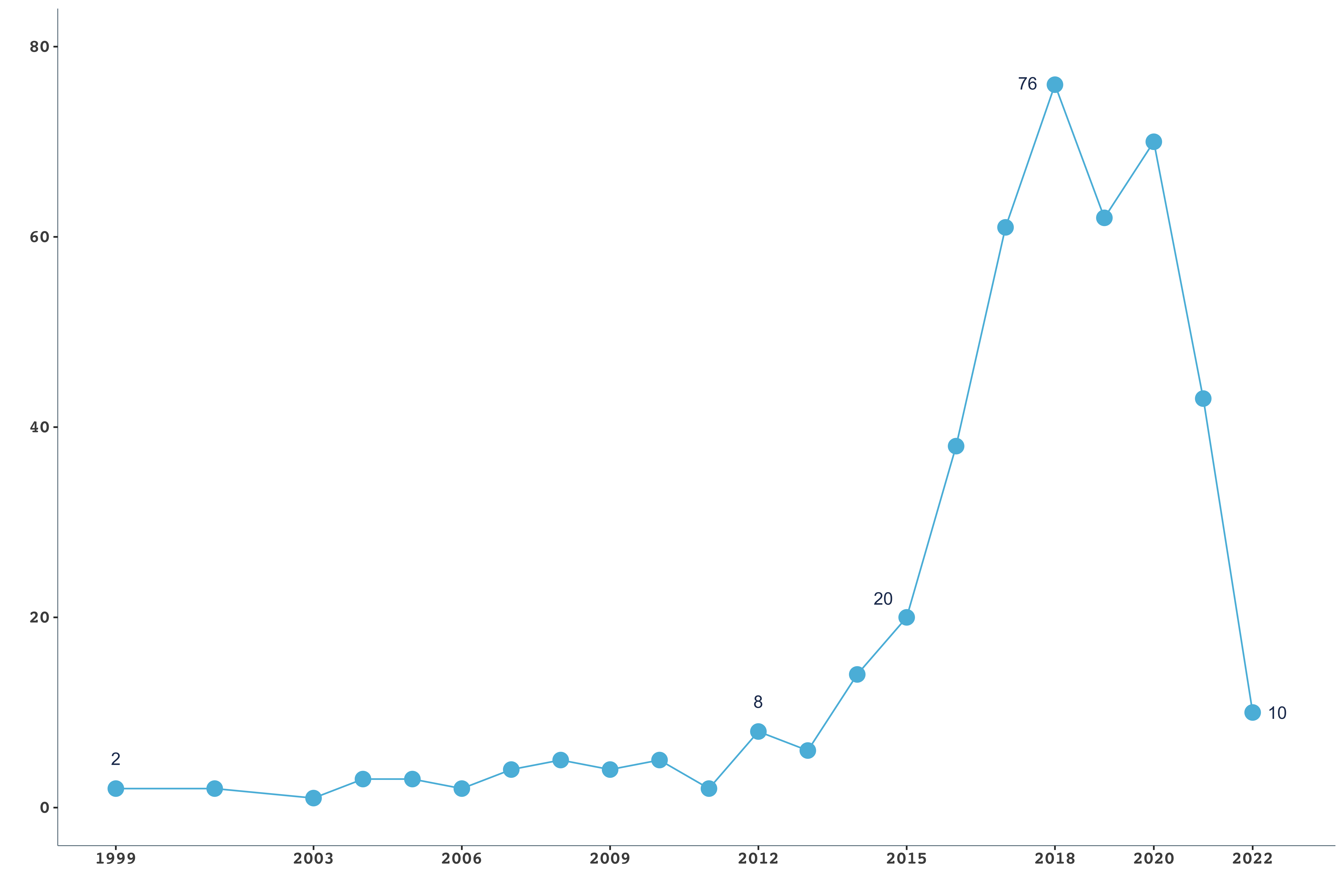

In Fig. 1, the yearly distribution of new start-ups per year is given. In our dataset, it appears that the number of start-ups founded has increased sharply starting in 2013, peaked in 2018, and has been slightly declining ever since. In Fig. 2, the global distributions of these companies are provided. Though it might be important to keep in mind that our dataset does not cover stealth start-ups with zero visibility and might have a lower representation of start-ups from non-English speaking countries.

.png)

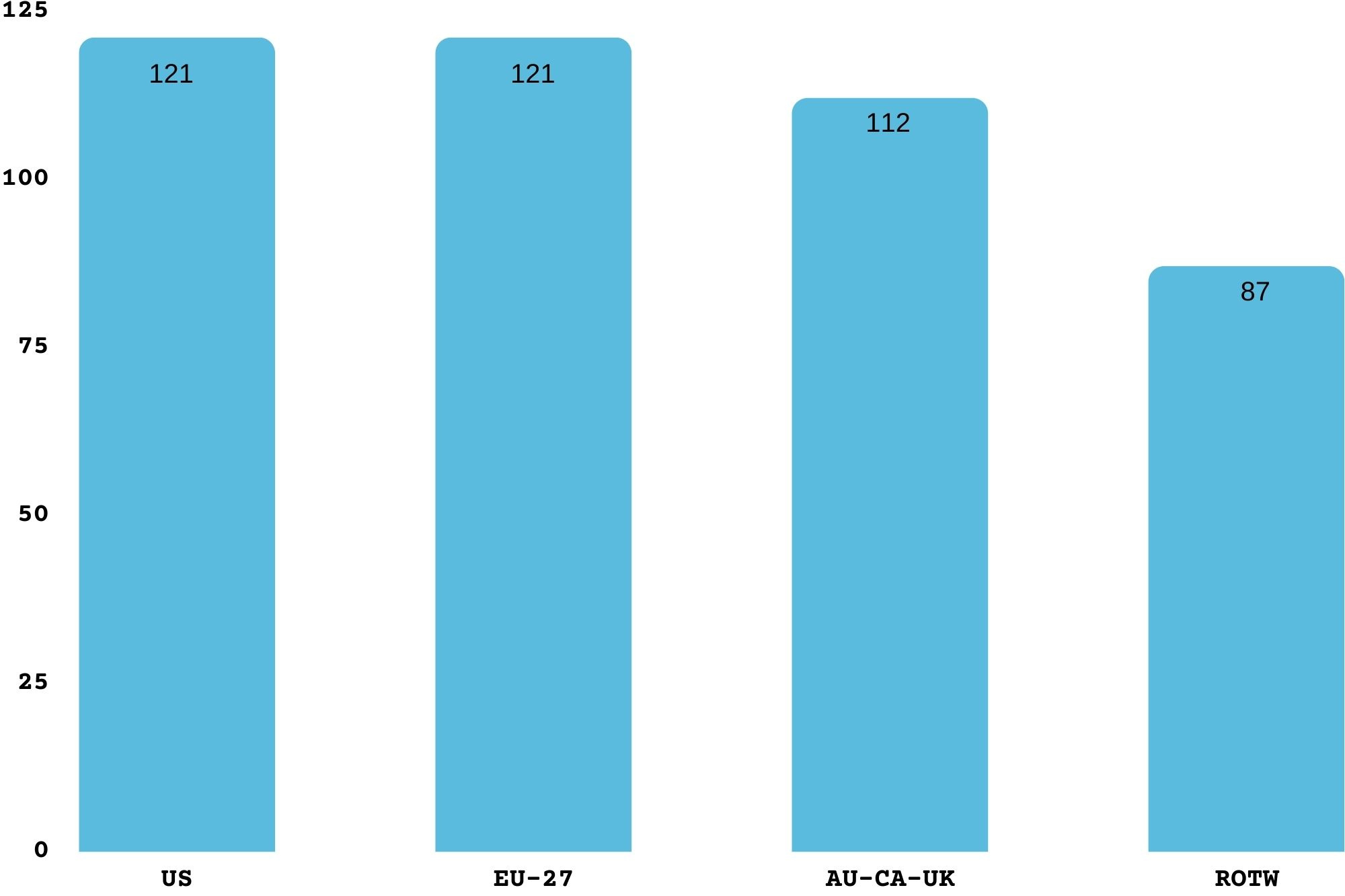

At this point, we would like to thank our reviewers because it was through one of their recommendations that we included a regional-level analysis, which can be seen in Fig. 3.

Fig. 3 demonstrates the additional insights that can be gained by comparing regions instead of countries. Here, it can be seen that in terms of sheer numbers of companies the US, the EU-27, and the AU-CA-UK are operating on similar levels. Meanwhile, the rest of the world (ROTW) does not possess that many start-ups. This can be related to the limitations of our dataset, the fact that start-up culture is more adopted by certain regions, some other factors, or a combination of these.

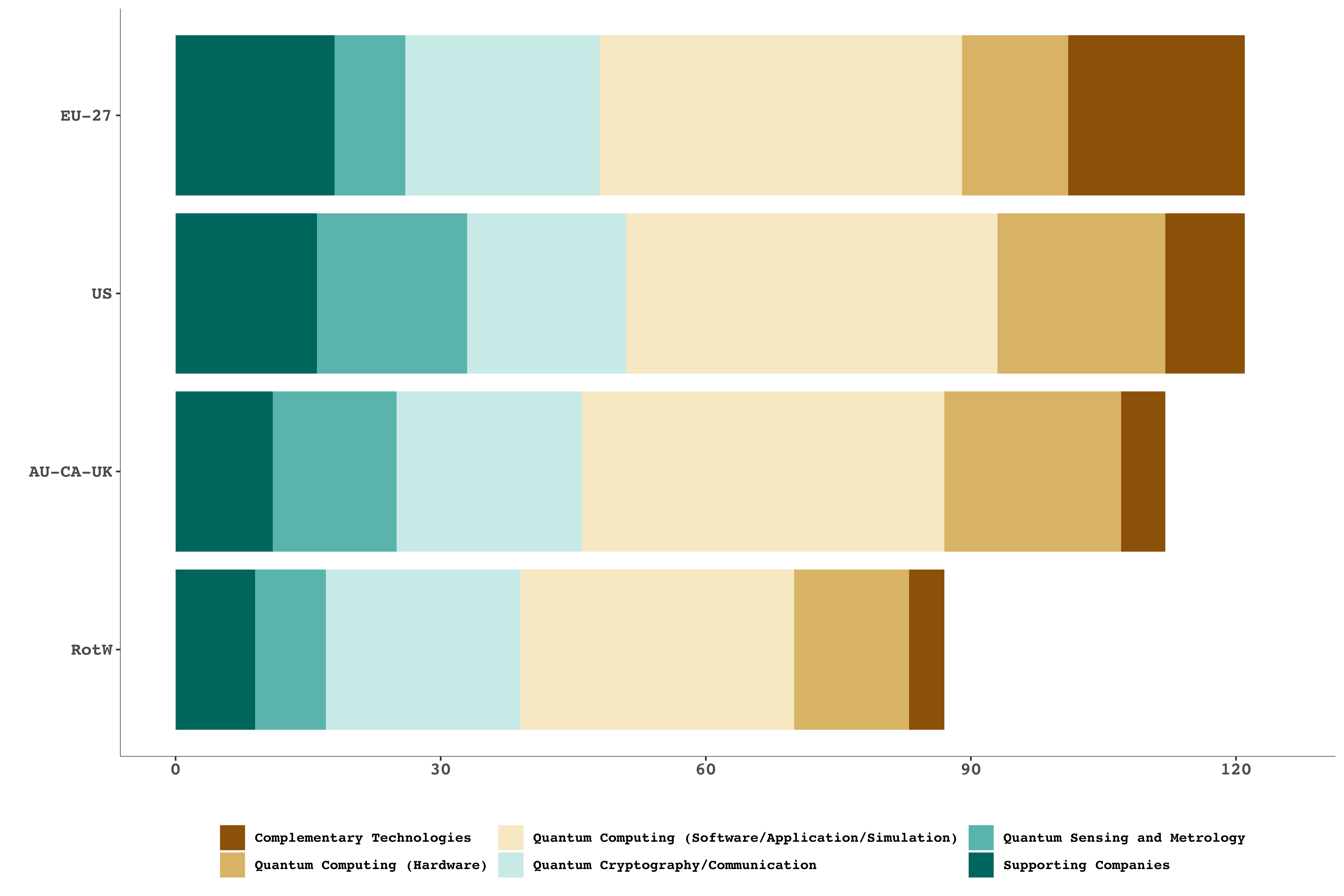

Finally, in Fig. 4, we present the type of companies in different regions. It can be seen that the EU-27 has more supporting companies and start-ups focusing on complementary/enabling technologies and quantum cryptography/communication start-ups, while the US has a strong lead compared to the EU in quantum sensing and metrology, and quantum computing hardware start-ups. This figure shows that the adoption of different fields of QT varies on regional levels, however, all regions have a presence in all the fields of QT.

We covered several other aspects of the dataset and discussed on potential insights that these analyses can provide us with respect to the landscape of the quantum start-up ecosystem. As a descriptive study, we hope this work can act as a good foundational work for future studies. The dataset can be improved by adding further information on companies like their size, valuation, investment amounts, and other aspects. Similarly, each field deserves a more in-depth analysis of its dynamics, and some questions are raised here such as the effects of the emerging cohort of supporting companies, whether the start-up activity can actually be connected to following policy decisions (in the form of national initiatives or programs), and what are the path-dependencies that are currently being set which will limit the opportunity space of future development of the field. Start-ups are considered to be an important aspect of the emerging ecosystem of QT, and exploring such questions can lead to a better-informed understanding of further steps to be taken.

[1] Gibney E. Quantum gold rush: the private funding pouring into quantum start-ups. Nature. 2019 Oct 2; 574 (7776):22–4.

[2] Overview on quantum initiatives worldwide – update 2022 [Internet]. QURECA. 2022. Available from: https://qureca.com/overview-on-quantum-initiatives-worldwide-update-2022/

Follow the Topic

-

EPJ Quantum Technology

This journal covers theoretical and experimental advances in subjects related to the emergence of quantum technology: a new praxis for controlling the quantum world.

Related Collections

With Collections, you can get published faster and increase your visibility.

Quantum Education

Second generation quantum technologies will have a major impact on education and training in the field of quantum physics. The progress in quantum computing, simulation, sensing, and communication will lead to the emergence of new industries with a corresponding workforce demand. In quantum industry, new job types will appear which require specialized qualifications. A certain understanding of quantum physics will be a necessary prerequisite to work in these professions. It will have to be taught to a much wider and much more diverse group of stakeholders than is the case today. Expanding audiences will include engineering, information sciences, pharmaceutics, finance and insurance, but also salespersons, CEOs and policymakers. Providing appropriate education and training offers tailored to the needs of these audiences will be a considerable challenge for both academia and providers of upskilling programs.

This topical collection aims to focus on novel approaches to address these educational challenges and their relevance for the quantum industry. Appropriate contributions to this topical collection include:

• discussion of new topics relevant for the teaching of modern quantum physics • new teaching methods and ideas, including the use of multimedia and new media • implementation of demonstration and student experiments • empirical results on learning difficulties and the effectiveness of novel approaches • results on the effectiveness of communicating quantum technologies to broader audiences and the general public • novel methodologies for workforce training and lifelong learning in quantum technologies • methodological considerations of the current and emerging infrastructures and ecosystem related to the workforce development pipeline

Every article submitted to the collection is expected not only to present new concepts and ideas but also to (a) include at least initial results of an empirical evaluation, and (b) make a case for the relevance of their work to the development of the quantum industry.

Publishing Model: Open Access

Deadline: Dec 31, 2026

Quantum Enabled Position, Navigation and Timing (PNT)

Society is dependent on Global Navigation Satellite Signals (GNSS) such as Global Position Systems (GPS) for position, navigation and timing (PNT) yet these signals are not available inside buildings, underground or under the ocean. These signals from space are only 10 nW at the earth’s surface and therefore are easy to jam, spoof or mecone. A key concern for many governments is that their critical infrastructure is dependent on these satellite signals especially for timing and synchronisation that is essential for the operation of utilities, communication, finance, transport, emergency and defence systems. There is therefore great interest in finding sensors and timing systems that can operate even when GNSS systems are unavailable, denied or spoofed.

This special collection wants to bring together papers from quantum technologies that can aid classical PNT in an area being called quantum enabled position, navigation and timing. Quantum technologies are defined in terms of the use of superposition, entanglement, squeezing, quadrature states (where the states are linked through the Heisenberg uncertainty principle) or single-photon approaches. The collection aims to provide up to date examples of the progress made using quantum or quantum enhanced approaches to timing and synchronisation, inertial sensing, all types of range-finding, sensors for geo-location, map matching, any other quantum technology sensor or system that can provide a benefit to PNT when satellite signals are unavailable, and quantum-classical hybrid solutions.

Submissions are welcome in the following areas:

• Atomic clocks, especially approaches aiming to improve the performance over commercially available clocks or reduce the size, weight, power and cost for PNT applications.

• Quantum-based frequency references, low-phase noise oscillators, frequency combs and other key components required in quantum enabled PNT applications.

• Methods for accurate synchronisation of atomic clocks, networks or distributed sensing systems especially those that use quantum effects for improved accuracy.

• Cold atom based inertial sensors including accelerometers, gyroscopes, gravimeters and gravity gradiometers.

• Co-magnetometer or atomic spin gyroscopes.

• Range-finding and LiDAR techniques using quantum technology approaches or systems including single-photon or other quantum-based sensing modalities.

• Map matching techniques using quantum sensors.

• Quantum approaches or quantum sensors for geo-location.

• Hybrid sensors or systems for PNT which include quantum sensors.

• Use of quantum approaches including superposition, squeezing or entanglement that provide a measurement advantage to any PNT sensors or systems.

• Use of quantum approaches to improve the performance of integrated inertial navigation systems or inertial measurement units.

Submission Information:

Authors should select the appropriate Collection title “Quantum Enabled Position, Navigation and Timing (PNT)” under the “Details” tab during the submission stage.

All manuscripts will undergo the journal’s standard peer-review process and will be subject to the standard editorial policies. Articles will be assessed, reviewed and published in this collection on a rolling basis.

Publishing Model: Open Access

Deadline: Mar 31, 2026

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in