Recessions are unpleasant. Businesses struggle, and people lose their jobs. This unpleasantness is a natural reason for policymakers to attempt to stabilize the economy by mitigating downturns. From the early 1980s until the Global Financial Crisis in 2007, they were remarkably successful, though this Great Moderation likely had some nonpolicy causes. This sounds good, but are there any downsides to a steadily growing economy?

Think about resistance and difficulty everywhere else. Muscles that are never strained never get stronger. The actual lifting of the weights isn’t always so fun, but the result is. I’ve started many seedlings to transplant in a garden, and I intentionally blow a fan over them to stress the stems with wind. Otherwise, they would be too weak when they leave the shed. The fastest direction to sail a boat is not downstream but perpendicular to the wind. Students who never struggle to learn never get stronger. As you may have heard a well-known quote, “There’s no comfort in the growth zone, and no growth in the comfort zone.”

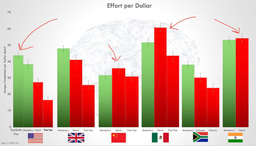

Could the economy need resistance too? I think so. Recessions used to be much more common, and growth rates used to be higher. There are many causes for this, but one of them is the frequency in recessions in earlier years. In my latest paper, The Link Between Economic Volatility and Growth and the Risks of Stabilization Policy in the Journal of Business Cycle Research, I estimate this relationship and explain it at length.

Recessions can have a cleansing effect, as some economists have noted. Free markets are efficient as a system, but not because they have no inefficiency. Inefficient businesses exist, but they do not survive recessions. Recessions thus “cleanse” the economy. Free markets are efficient because they get rid of inefficiency. Even businesses that were succeeding quite nicely have to rethink what they are doing and root out any inefficiency to continue to perform well. Recessions are not just a matter of forcing bad firms out of business; they are an opportunity for good firms to get better. Long-run growth increases.

I should emphasize here that recessions that start in the real sector as ordinary business cycles are cleansing. Financial crises are fundamentally different, and they can harm efficient, well-run businesses, and they can quickly worsen far beyond a real sector downturn. Avoiding financial crises is separate from stabilization policies, though, and is likely a matter of a few sensible rules on certain practices.

The main point of this paper is that successful stabilization policies may reduce long-run growth by letting inefficiency persist. When they succeed at mitigating a downturn, the inefficiency is not corrected.

This is pretty simple, but as the research article details, the picture is in fact more nuanced. There were multiple causes of the Great Moderation, not just stabilization policy. Moreover, the effect of stabilization policy has not been the same throughout the Great Moderation and ongoing growth since the Great Recession. At different times, fiscal and monetary policy have each done more to affect volatility and growth of GDP than the other. The key takeaway is that successful stabilization carries risks that should be evaluated alongside benefits. This is especially so because long run effects are not generally part of the stated objectives of stabilization policy.

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in