ESG - Questionaire Scoring & Probabilistic Evaluation

Published in Mathematics, Business & Management, and Economics

Explore the Research

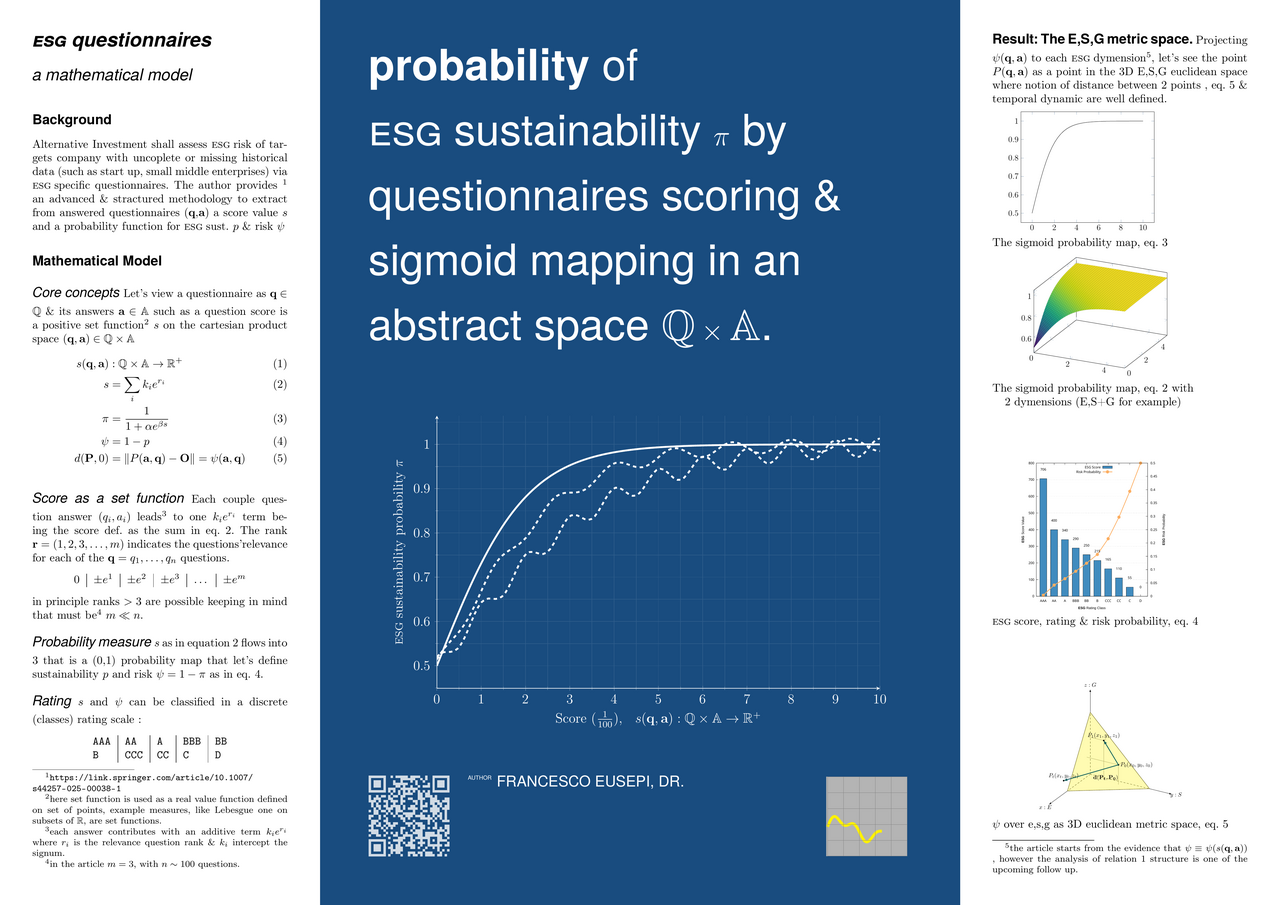

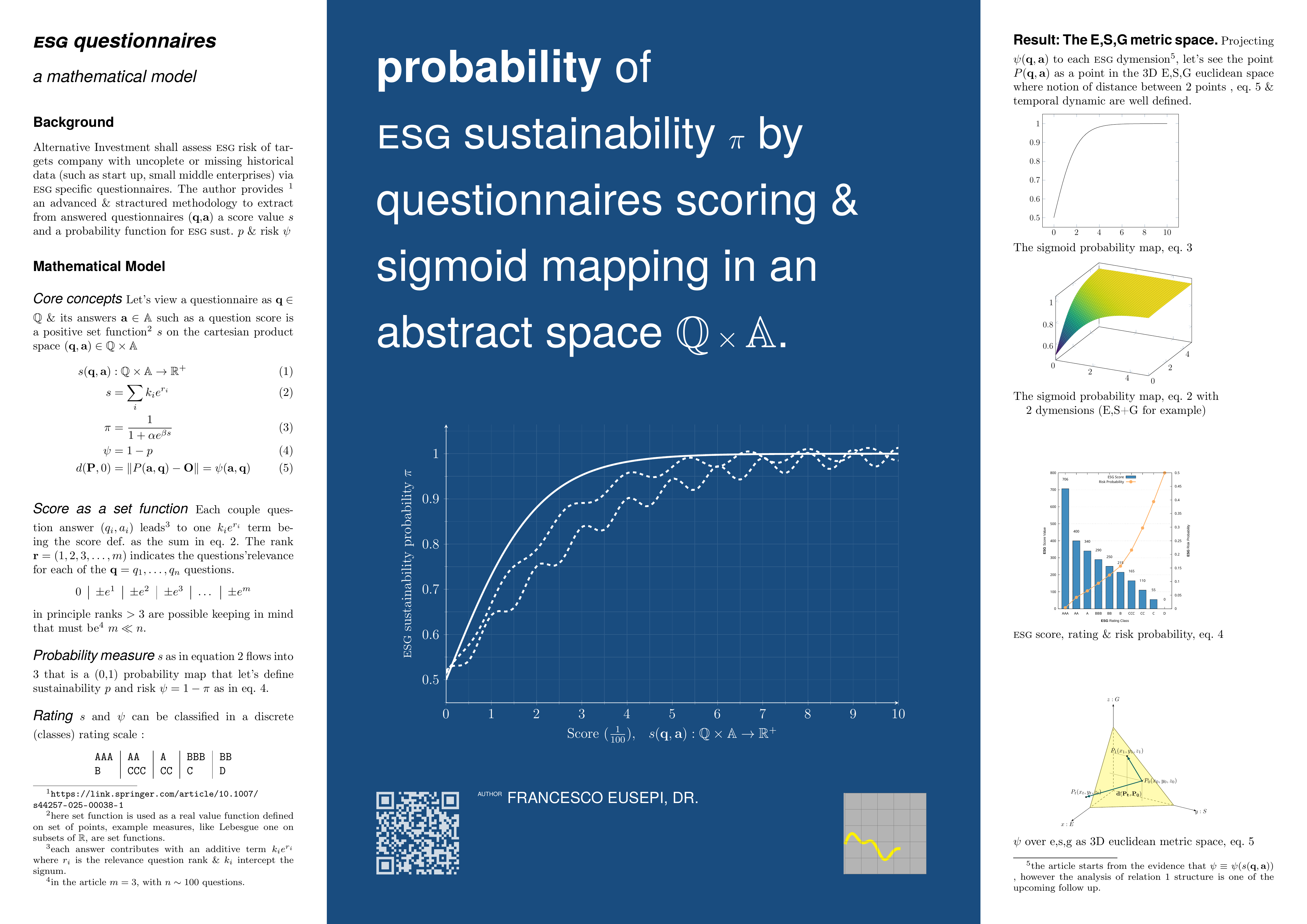

Quantitative ESG scoring model and metric for alternative investments and venture capital targets

Introduction & Background

In the alternative investments business (funds, funds of funds investing in start up or small - middle enterprises) where available ESG-related data are rare / very scarce or even not available at all, investment's targets may be ESG-assessed via questionnaire.

Questionnaire are seen as valid qualitative instrument (ex. due diligence questionnaires - DDQ) for qualitative assessments but not yet seen as valid qualitative source of information. Actually an open question, without currently a unique answer in the corporate world, is how to quantitatively measure questionnaires results in this field and if/how to produce an ESG sustainability / ESG risk probability based on the questionnaire results.

The article provides an answer to this question, developing a structured quantitative framework to score and interpretate the results of an ESG questionnaire from a very general perspective, providing also empirical data (companies ESG Assessed) in small measure but looking forward to produce available statistical points.

Behind-the-scenes

The approach followed by the author (please look into the poster for a synthesis and in the articole itself for details) is to start with an abstract mathematical approach thinking the questionnaire and its answer as a QxA cartesian set and the score value as a set function symilar to a signed measure (even if it's real set function nature is the relevant one). Seeing the score as a set function it's possible to rethink it as a probability, mapping it in 0,1 (via a sigmoid function in the article but it is valid for a general probabilistic mapping). Both ESG Score and Probability will have specifics (these are valid topics to follow up) however they already provide the quantitative framework to develope an ESG metric answering the "open question" the Business community has and also deriving results to abilitate the usage of questionnaires for scoring purpposes.

Summary of main results

The article introduces a new mathematical approach that uses modern mathematics to answer the interrogative, considering scoring a questionnaire the result of a real value set function / similar to a measure on the answer space and linking the score value to an ESG-risk probability via a score-probability mapping with a probabilistic interpretation.

The methodology introduced for these specific types of questionnaires, being abstractly defined, is applicable to other questionnaires type where Y/N answer are the possible outcomes, it is however been developed for ESG questionnaire.

The article shows some empirical results of the methodology developed and opens to a broaden application both empirical (submitting questionnaires to more available companies) and theoretical digging into the possible quantitative implication of the approach introduced leveraging from the parallelism introduce between a questionnaire to be scored and the building of the real valued set function s as it would be a random walk, with the score value advancing when the answer is ESG-positive and stepping back (or staying still) when the answer is ESG-negative.

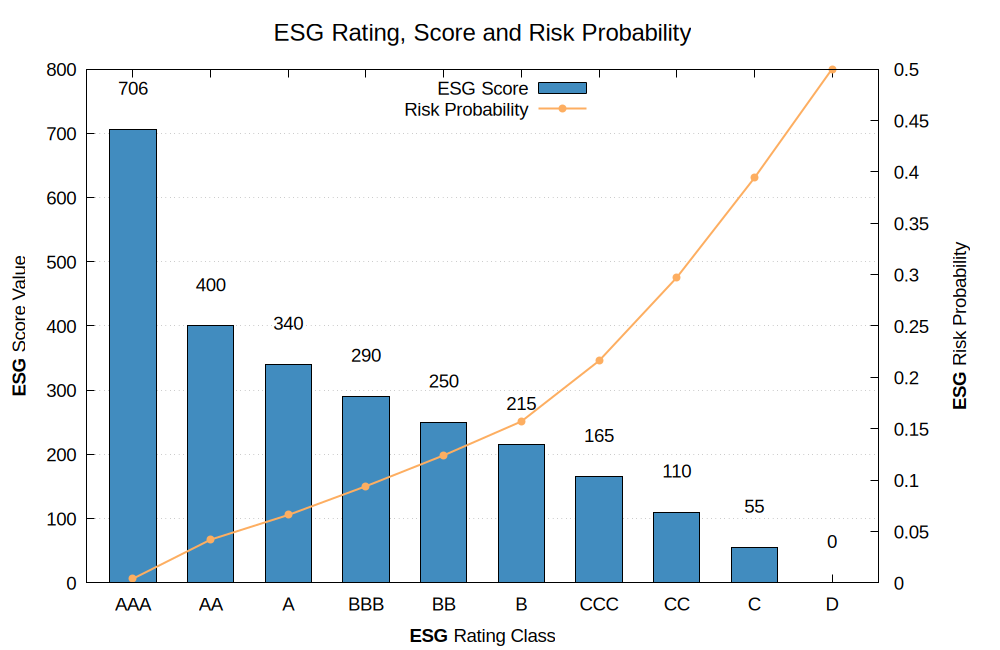

Theoretically the article describes answering a questionnaire like a score function walk where the measure value s increase or decreases (Y/N) based on the questions’ answers. 2 models are introduced one where positive answer get +1 and negative -1 (s is signed) and a model where positive answers get +1 and negative answers 0 (s is always positive). The question relevance is taken into account by a rank r ∈ (1,2,3) and each answer has a contribution of type (±1 er ), with an exponential behaviour able to intercept questions with differenct degrees of impact actually low (r=1), middle (r=2) and high (r=3). The summed score s is mapped into a probability by a 1 parameter sigmoidal of type 1/(1 + e-x ) function that is chosen among other probability mappings for its limited growth underlying assumptions and deep probbailistic interpretation. Also, a distance between scores is finally derived. The model tries to introduce a rigorous approach in scoring the ESG questionnaire embracing the opportunity to have a normalised value (probability) to compare each company measurement and a company in time.

Empirically the questionnaire is applied to few (4) companies and future publication will bring more empirical points / scored companies.

Follows up and topic to discuss.

A set of topics introduced in the article are open to follows up in both theoretical and empirical application. A (non complete) list:

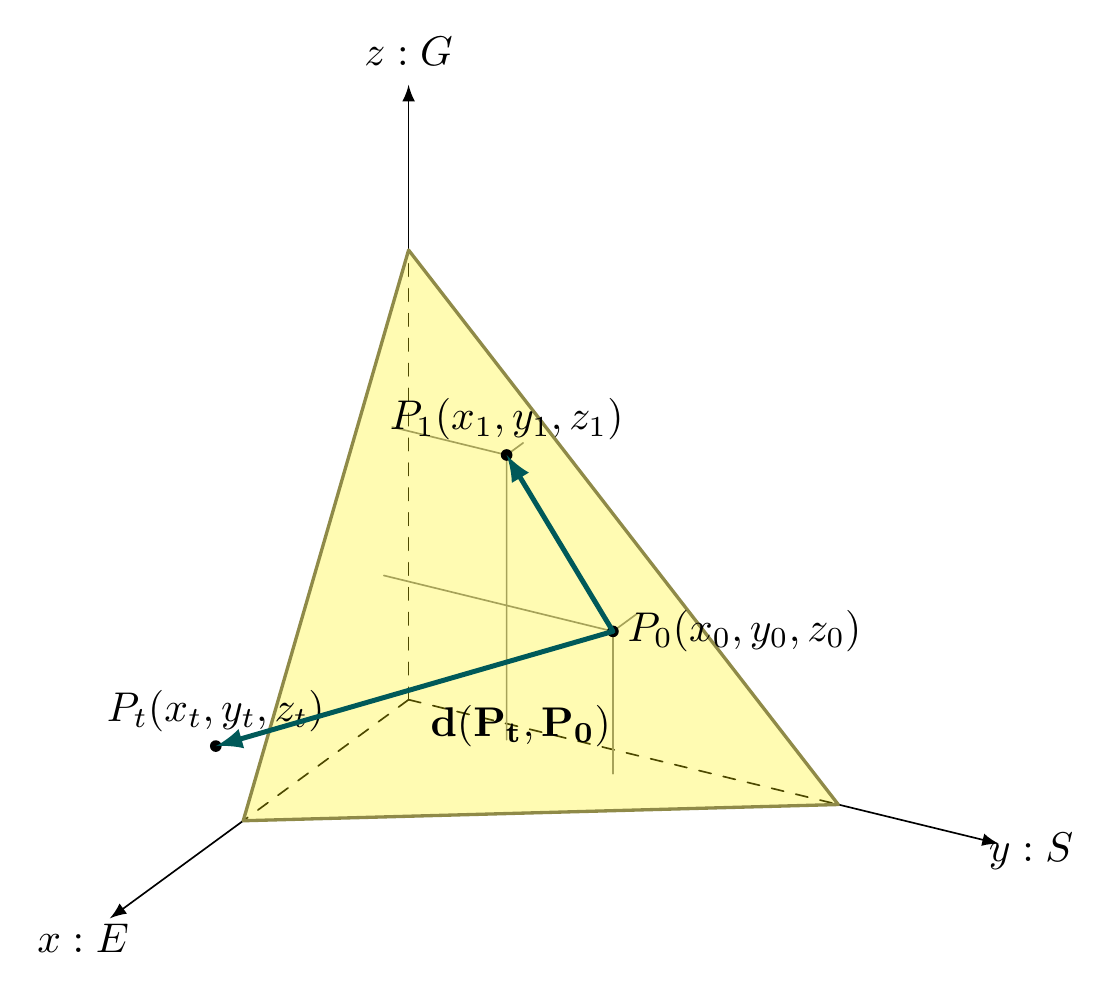

1. The idea of having a set function on the c & a probability associated with it, has been merged with a “dimensional” view where each E,S,G dimension is assimilated to an x, y , z euclidean space with therefore a dynamic (temporal evolution of P) . It turns out the opportunity to measure the distance between P on different times for 1 company and P between different companies (in general P between different questionnaires). This line of theory had been only sketched suggesting to acknowledge that the dynamical system for P in the E,S,G space should be investigated usyng metric spaces and dynamical systems techniques.

2. The choice of the Sigmodial function to map the set function score value into a probability (0,1) has deep roots, however it's not the unique choice & a general investigation on probability mappings is definetly an avilable line of research.

3. The notion of score as a set function can be extended and made more rigorous taking from measure theory and its implication. An even higher degree of abstraction can be introduced above the idea of a questionnaire answer space. The process of making abstract a theory is very valuablee and opens to new and unexpected results. Same for the idea of a (random) walk as building up the final score value is a line of research.

4. Empirically a set of questionnaire will be submitted to more companies and real statistical data will be driven in order to assess evolution of the ESG score & probability as well avareges values among business classes and cases.

5. Finally Survey of acutal corporate world questionnaire scoring is definetly valuable as it seems that in ESG (and not only) questionnaire are yet understimated as assessment instrument while lacking quantitative perspective that the author belive the present article has helped to retrieve and support.

Conclusions

The idea of having a set function on the answer space and a probability associated with it has been merged with a “dimensional” view where each E,S,G dimension is assimilated to an x, y , z space with therefore a dynamic (temporal evolution of P) and therefore possibility to measure the distance between P on different times and P between different companies (in general P between different questionnaire). This line of theory had been sketched suggesting to acknowledge that the dynamical system for P in the E,S,G space should be investigated.

Pictures.

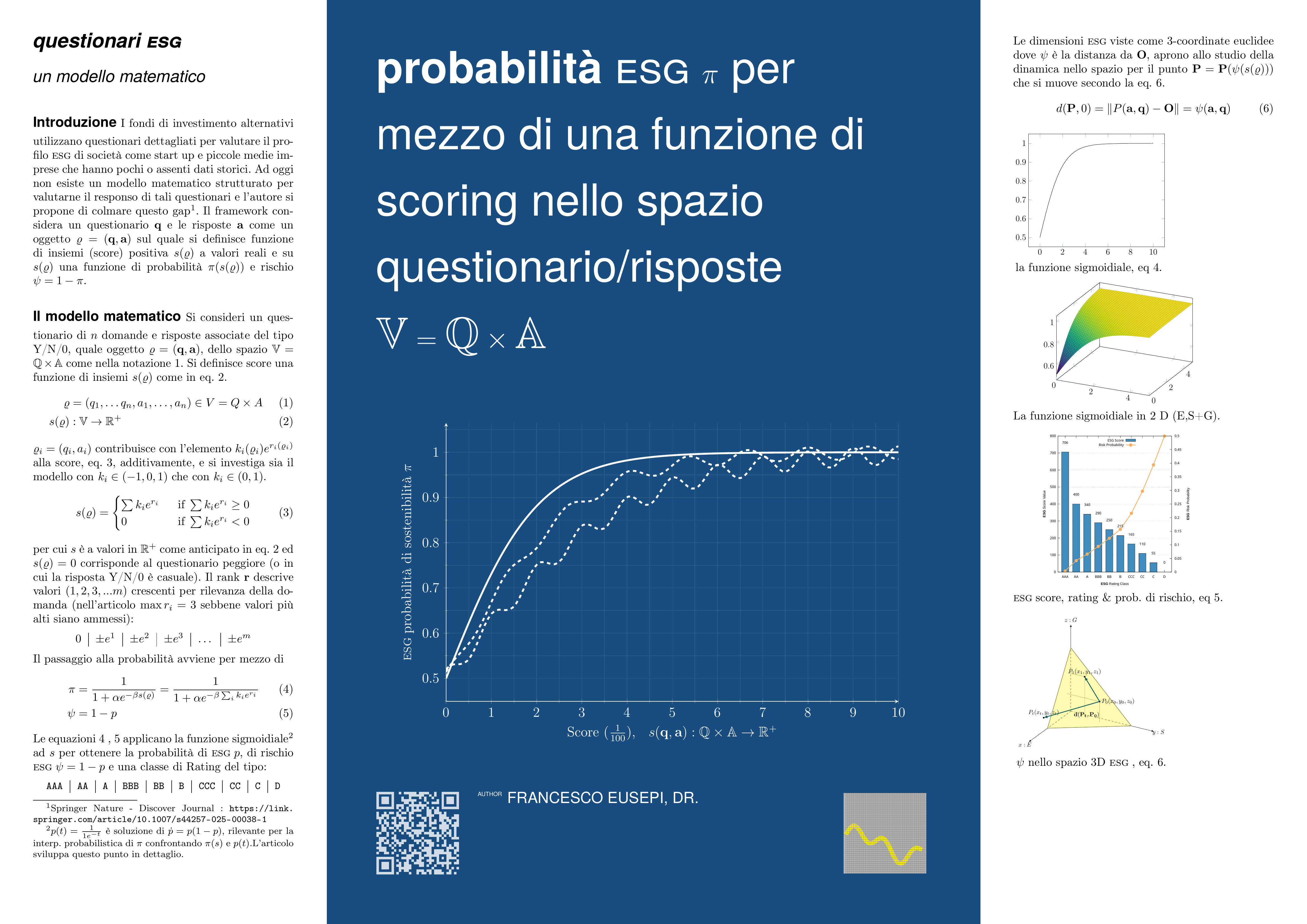

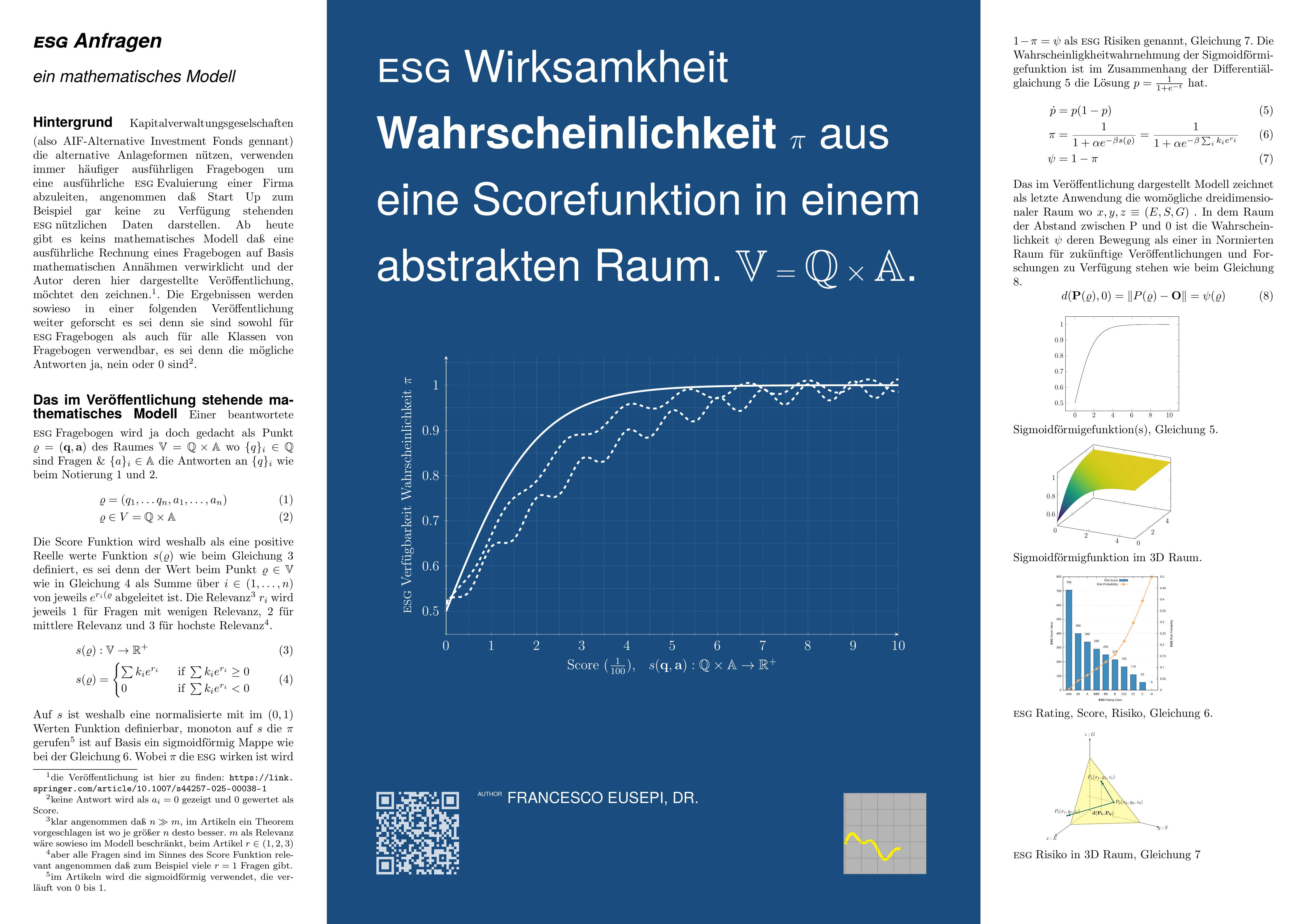

The attached figure shows the Rating scale, defined for each score range and the associated sigmoidal probability function that (increasing as the score decreases) provides a probabilistic interpretation of the set function defined via the score value.

In the following picture, is provided a representation of the ESG score risk probability as a point in the 3 dimensional E, S, G space, where distance between P on different times (and between different companies) is definable and measurable.

Article Poster as concise summary.

The summary poster had been done also in German and in Italian language as per completeness in order to be as sharable as possible. both are here attached.

Follow the Topic

-

Discover Analytics

This is an international, open access journal that publishes research on computational, mathematical, methodological, and descriptive aspects of analytics.

Related Collections

With Collections, you can get published faster and increase your visibility.

Data-Driven Approaches for Financial Complexity and Risk Analysis

Financial markets have evolved significantly over the centuries, from simple barter systems to complex, interconnected global networks. This evolution was even faster in recent decades, driven by technological advances, globalization, and disruptive events, demanding advanced analytical tools to assess risk, decipher market dynamics, and analyze interdependencies. This Collection aims to address the challenges posed by this complexity by applying advanced analytical tools and methodologies. We invite research that employs data-driven techniques, network science, and computational methods to enhance our understanding financial phenomena.

The evolution of financial markets has been marked by several key milestones, including the establishment of the first stock exchanges, the globalization of trade, and the advent of electronic trading platforms. In recent years, the rise of cryptocurrencies and blockchain technology has introduced new dynamics and opportunities, further complicating the landscape. Crises, whether financial, economic, or sanitary, profoundly impact financial markets. Historical events such as the Great Depression, the 2008 financial crisis, and the COVID-19 pandemic have demonstrated the vulnerability of financial systems to extreme events. These crises often lead to high volatility, significant market downturns, and long-lasting economic repercussions. Understanding the mechanisms behind these impacts is crucial for developing resilient financial systems.

We invite contributions that address, but are not limited to:

1. Systemic Risk Analysis and Financial Stability:

• Systemic risk assessment and contagion modelling in financial networks

• Impact of financial, economic, and health crises on system stability

• Effects of extreme events (e.g., wars, natural disasters) on global markets

• Climate-related financial risks and stress testing

• Geopolitical and macroeconomic shocks on financial markets

2. Market Dynamics and Information Flows:

• Real-time investor sentiment and behavior analysis

• Information propagation and contagion in financial networks

• Impact of social media and news on market fluctuations

3. Financial and Technological Innovation:

• Evolution and impact of crypto-assets and blockchain technology

• Risk and opportunity analysis in FinTech and DeFi

• High-frequency trading algorithms and their influence on market microstructure

4. Advanced Modelling and Forecasting:

• Machine learning and AI applications in financial prediction

• Asset pricing models based on big data

• Non-linear time series analysis techniques for financial data

5. Regulation and Governance:

• Analysis of regulatory policy impacts on market dynamics

• Fraud and anomaly detection using data science techniques

• Ethical and privacy implications of big data in finance

6. Global and Sectoral Interdependencies:

• Complex network analysis mapping interconnections between markets and sectors

• Impact of geopolitical changes on international financial relations

• Spillover effects between traditional and emerging markets

7. Cryptocurrencies and Digital Assets:

• Market integration and correlation with traditional assets

• Regulatory challenges and adaptations in the crypto space

• Financial innovation and disruption through DeFi and tokenization

By fostering interdisciplinary collaboration at the intersection of finance, economics, and data science, this Collection aims to provide deeper insights into financial structures and support informed decision-making in today’s volatile markets. We encourage submissions that utilize statistical modelling, machine learning, and complex systems analysis to uncover new perspectives and solutions in financial research.

Keywords: Financial Networks; Risk analysis; Information Flow; Computational Finance; Machine Learning in Finance; Econophysics; Statistical Modelling; Asset Pricing; Financial Stability; Data-Driven Finance

Publishing Model: Open Access

Deadline: Jun 01, 2026

Data Analytics in Finance and Accounting

The field of finance and accounting is undergoing a profound transformation as data analytics becomes a key driver of decision-making, performance evaluation, and strategic forecasting. This Collection of Discover Analytics invites high-quality, original research that explores the growing role of data analytics in finance and accounting practices, including emerging methods, applications, technologies, and implications for professional practice and policy.

We welcome contributions that engage with, but are not limited to, the following topics:

• Predictive and prescriptive analytics in corporate finance and auditing

• Data-driven decision-making and real-time analytics for CFOs and finance teams

• Applications of artificial intelligence and machine learning in financial modelling

• Business intelligence tools and dashboards for performance monitoring

• Big data and non-financial data integration in financial reporting

• Ethics, governance, and data quality in finance-related analytics

• Hybridisation of financial talent with data and analytics skills

• Use cases from industry (e.g., utilities, retail, public sector) demonstrating advanced analytics adoption

• SME adoption of analytics tools and their implications for accountancy

• Methodological innovations in finance and accounting data analytics (e.g., CRISP-DM, process mining)

• Modelling and forecasting High-Frequency financial data

• Investment, portfolio analysis and credit risk analysis

• Tax analytics and fraud detection

This Collection seeks to identify key trends, such as the increasing role of non-financial data, the evolution of the finance function into an enabler of enterprise-wide analytics, and the need for finance professionals to develop new analytical competencies in an Industry 4.0 context.

This Collection welcomes submissions from researchers worldwide while also including selected papers presented at FAME (19-20 Sept, 2025, Heraklion, Crete). All submissions will undergo a rigorous peer-review process to ensure high-quality contributions. We invite scholars in related fields to submit their work and contribute to the advancement of Data Analytics in Finance and Accounting.

Publishing Model: Open Access

Deadline: May 31, 2026

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in