Financing the Blue Carbon Wealth of Nations

Published in Social Sciences, Sustainability, and Economics

Mangroves: An Asset in Decline

As natural infrastructures, mangrove forests help to protect nearby populated areas by reducing erosion and absorbing storm surge impacts during extreme weather events. In Australia, for instance, they provide almost AUS $ 2bn in value in avoided damages to coastal property. As multi-service provisioning coastal ecosystems located in more than 110 countries across the world, they host habitats for fishes, birds, and other species, thus enhancing biodiversity. Plus, they help counteracting pollution through filtration. Accordingly, they support important socio-economic-cultural services for livelihoods of over 4 million fishers and human well-being. Mangroves are unsung heroes in coastal prosperity.

Their deterioration is ongoing, albeit it has been slowing down in recent years. Over half of the world’s mangroves have been lost to degradation and deforestation due to urbanization and extractive activities.The ‘Global Mangrove Alliance’ estimates a net loss of 5,245km2 since 1996. There are estimated 147,000 km2 of mangroves remaining worldwide, an area about the size of Bangladesh. Around 818,000 ha are currently considered as restorable area. Decline needs to be reversed through participatory coastal governance and large-scale re-establishment – finance is needed for an uptake of mangroves world-wide.

Carbon-storing superpower

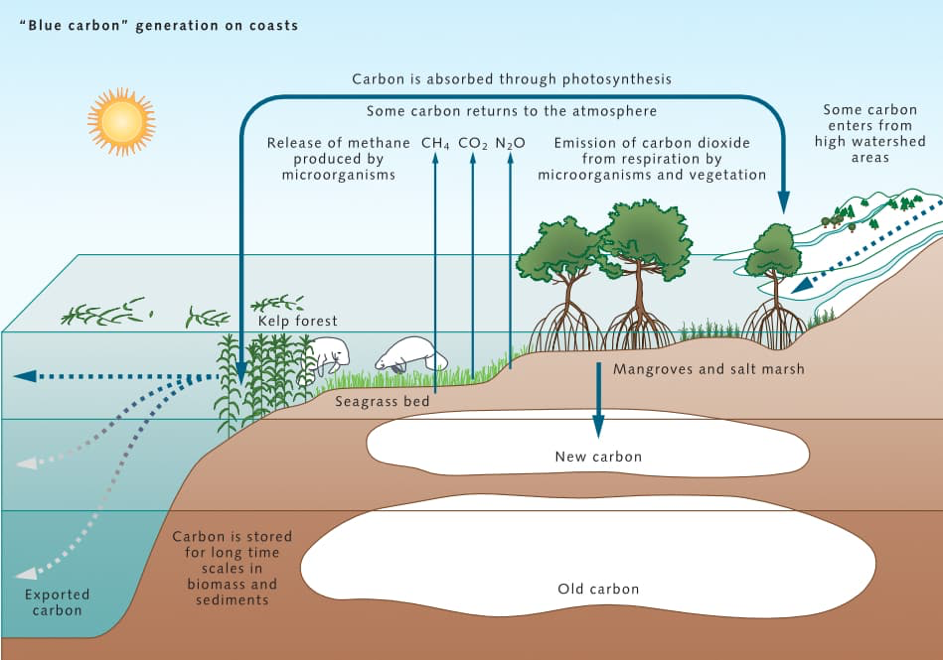

Recognizing their contribution for ‘blue carbon’ is a future driver towards restoration and afforestation, i.e. the amount of carbon that could be sequestered for climate change mitigation in coastal ecosystems of mangrove forests, salt marshes and seagrass meadows. Mangrove forests store up to ten times more carbon per hectare than terrestrial forests. According to ‘Conservation International’ this carbon-storing potential makes mangroves an essential solution to climate change.

Image: ‘Blue Carbon Generation on Coasts (below). Source: WOR8

Being characterized as ‘blue carbon wealth of nations’ (Bertram et al. 2021), countries in the Global South could be receiving substantial transfers based on carbon offsetting. On top of large countries like Indonesia or Brazil, a range of small developing countries with almost zero emissions could be benefitting from substantial compensations.

Global potential to store carbon emissions is tentatively estimated in the order of 3% of current emissions (Macready et al. 2021), i.e. it is unlikely to be the solution. However, the overall climate solution provided by mangrove forests is roughly equivalent the current emission amount of Germany. Comparing the massive finance needed for ongoing climate mitigation in industrialised countries would dwarf much-needed investments into the natural capital of mangrove forests.

Drivers from Policy and Business: a Momentum for Mangroves

Policy-makers and business are lining up to protect mangrove forests. The delivery of the Paris Agreement on Climate Change, the Convention on Biological Diversity and the Ramsar Convention on Wetlands are leveraging on the precious role of mangroves. The 2023 COP in UEA proposed a global target to restore and protect 15 million hectares of mangroves and halt mangrove destruction by 2030. In line, Microsoft has been investing in ‘Delta Blue Carbon’ in Pakistan as the world’s largest project and shares updates on lessons learned. Australia now uses the approach in their ‘Nationally Inventory Report’ (NIR), i.e. as part of their acknowledged policy measures against climate change.

Setting a transparent and verifiable standard with independent review is key. So far, voluntary standards are provided by few consultancy-based organisations: ‘VERRA’ could underpin provisions made in the US Inflation Reduction Act, so efforts made by industry could be counted in the American Carbon Registry. The ‘High Level Ocean Panel’ provides a handbook on the topic to facilitate action. ‘Climate Action Reserve’ ‘Plan Vivo’ and ‘FairGrove’ are emerging as like-minded players. For sure, business will be interested in offsetting emissions and considering more activities abroad when future abatement options towards net zero become costly and difficult.

Contemporary downside is that an overwhelming majority of offsetting projects world-wide done in last years, including those in rainforest areas, are considered unreliable and worthless.[1] Hence, investors should pay attention when shovel-ready mangrove (re-)establishment projects are being set up. Durability of carbon storage, monitoring parameters, transparency, and independent verification need more and continuous rigour; an affiliation of standard-setting bodies at UN-level seems desirable (Van Dam et al. 2024).

Stewardship in Light of Scientific Uncertainties

Right now, there is a gap between policy and market drivers on the one hand, and a strive for scientific robustness along with local ecosystem benefits on the other. Recent findings (Merk et. al. 2022) indicate that the value of carbon storage might be considered low compared with the overall contribution of those ecosystems to local well-being. A key contribution, therefore, can be expected to come from assessing co-benefits on the ground. Key to stewardship will be connecting with local people and stakeholders. The rising wave of lawsuits seeking to hold governments and companies to account for climate action provides further incentives for responsibility. Good corporate governance, hence, should weigh-in stewardship with coastal communities and co-develop pathways for mangrove restoration. Monitoring done by unmanned aerial vehicles such as drones, key performance indicators, and modelling-based impact assessments will complement efforts and prepare upscaling.

A Financial Roadmap

Launching the ‘Mangrove Breakthrough Financial Roadmap’ in late 2023 has been a galvanizing call to action. Supported by multiple countries covering around 60% of the world’s mangrove forests and by a range of stakeholders, it pledges that unlocking $4bn investment by 2030 could secure the future of mangrove forests and their ecosystem services. A Blue Mangrove Fund has been set up by a Belgian NGO and their counterpart from Bangladesh. The High Level Ocean Panel concludes that all such measures to protect and restore mangrove forests could have a benefit-cost ratio of 3:1, i.e. €1 investments yields benefits of €3 (Konar & Ding 2020).

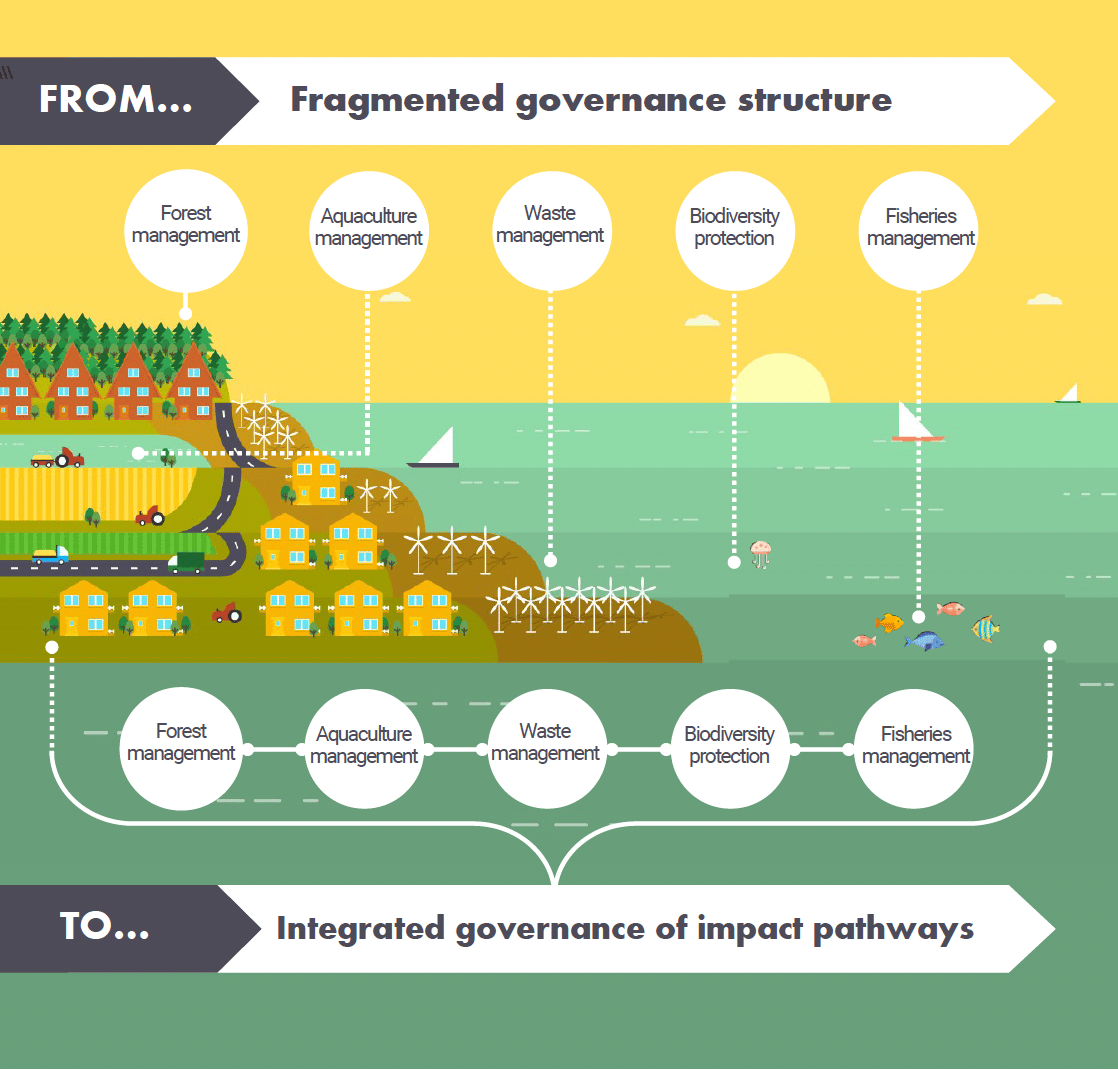

The Global Mangrove Alliance has been setting up a restoration tracker tool for practitioners to enable knowledge sharing. The investor tool ‘mangrove transition curve’ maps this landscape of opportunities. It identifies phases of development and emerging business models: ranging from aquaculture to eco-tourism, to Marine Protected Areas and Marine Spatial Planning. Waste infrastructure and clean energy matter too. Critical enablers are the legal conditions for traditional land owners and users, especially indigenous people and local communities, and confidence in inclusive and responsible blue carbon projects. Impact investing would address those measurable socio-ecological benefits. Business becomes nature-positive. Policy frameworks would set the scene on transparency and accountability.

Image: Integrated Coastal Governance. Source: UNEP IRP 2021

What business and investors can do is the following: (i) set a science-based quality bar and a sound evaluation framework with stakeholders, (ii) determine alignment with business and local priorities towards prosperity enhancement, (iii) leverage financial multipliers by de-risking in form of blending grants with other funding sources. Commercial finance can contribute to the mangrove financial roadmap.

Outlook: Buy-in Needed With Both Eyes Open

For years and decades to come, combatting climate change will be on the agenda. Evidence is increasing on the need for smart adaptation combining resilience with mitigation. Investing in mangrove forests re-establishment is almost a one-size-fits-all strategy through coastal protection, blue carbon storage, and multiple local benefits for livelihoods and biodiversity. The financial roadmap paves the way for multiple activities done by alliances of investors, business, communities, policy-makers, and research. It needs delivery and upscaling around the world. Keeping both eyes open on trends in measuring co-benefits with accountability will be key in delivering on the blue wealth of nations. Impact investment could be key in future coastal prosperity in solidarity with the Global South.

Sources:

Bertram, C. et al. (2022) The blue carbon wealth of nations. Nature Climate Change. https://doi.org/10.1038/s41558-021-01089-4

Bourgeois, Carine F. et al. (2024) Four decades of data indicate that planted mangroves stored up to 75% of the carbon stocks found in intact mature stands. Science Advances 10 5430.DOI:10.1126/sciadv.adk5430

Global Mangrove Alliance & the UN Climate Change High-Level Champions (HLCs) (2023) Mangrove Breakthrough: Financial Roadmap, in partnership with Systemiq.

Konar, M. & Ding, H. (2020) A Sustainable Ocean Economy for 2050: Approximating Its Benefits and Costs. High Level Ocean Panel. https://oceanpanel.org/publication/a-sustainable-ocean-economy-for-2050-approximating-its-benefits-and-costs/.

Macreadie, P. et al. (2021) Blue carbon as a natural climate solution. Nature 2: 826 - 839

Merk, C. et al. (2022) The need for local governance of global commons: The example of blue carbon ecosystems. Ecological Economics 201. https://doi.org/10.1016/j.ecolecon.2022.107581

Van Dam, B. et al. (2024) Towards a fair, reliable, and practical verification framework for Blue Carbon-based CDR Environmental Research Letters, in press https://doi.org/10.1088/1748-9326/ad5fa

Reading tip:

World Ocean Review 8 (2024): The Ocean – A Climate Champion? How to Boost Marine Carbon Dioxide Uptake. https://worldoceanreview.com/en/wor-8/

Helen Czerski (2023) The Blue Machine: How the Ocean works. London (W.W. Norton & Penguin Books)

[1] The Guardian, 18 January 2023; see: https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe

Follow the Topic

What are SDG Topics?

An introduction to Sustainable Development Goals (SDGs) Topics and their role in highlighting sustainable development research.

Continue reading announcement

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in