From Awareness to Assurance: What Two Saudi Studies Reveal About AI’s Next Chapter in Accounting

Published in Computational Sciences, Business & Management, and Philosophy & Religion

Artificial intelligence is moving quickly from experimentation to operational reality in accounting—automating routine work, strengthening controls, and reshaping the accountant’s role toward interpretation, governance, and assurance. However, adoption is not determined by technology alone. Human factors (awareness, trust, skills, readiness for change) and institutional conditions (ethics, oversight, regulation) increasingly determine whether AI improves accounting outcomes or introduces new exposure.

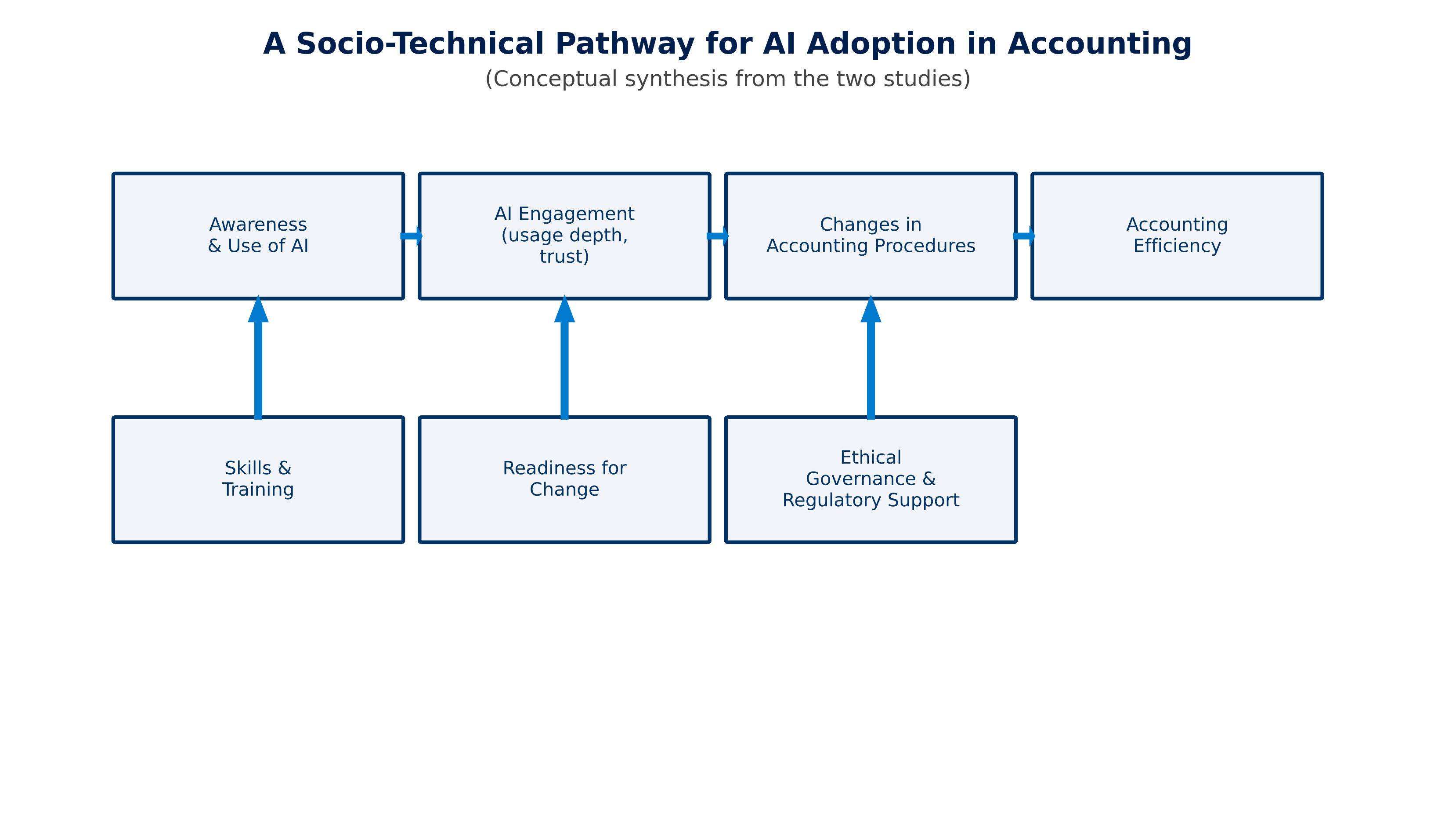

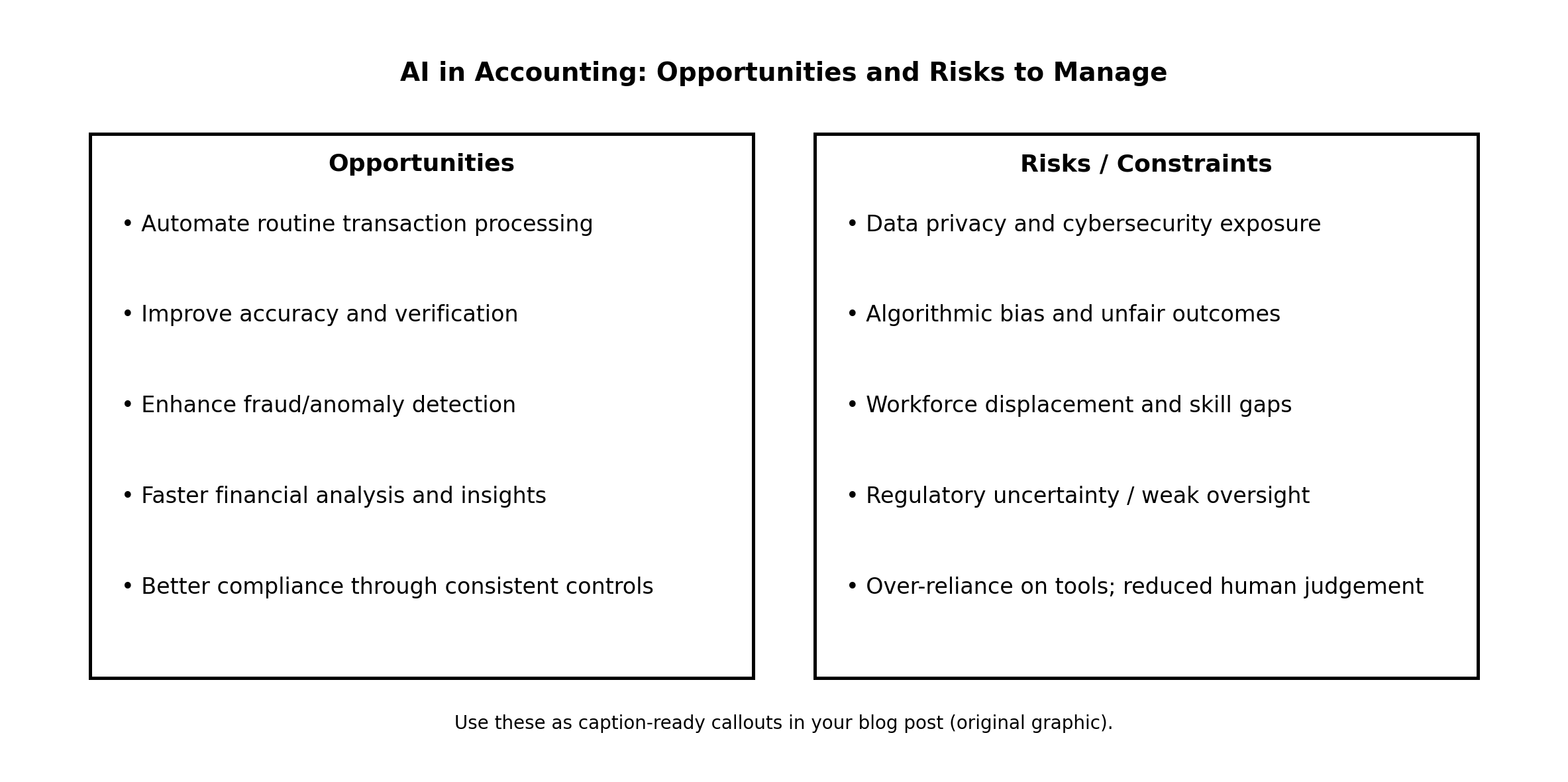

Two recent Saudi-based studies offer a useful, evidence-led snapshot of this shift. One study of accounting professionals finds that AI awareness and usage are associated with deeper AI engagement, which links to perceived changes in accounting procedures and, ultimately, higher accounting efficiency (Mgammal, 2024). A complementary study of accounting academics—positioned within the national digital transformation agenda—highlights both the upside (automation, accuracy, fraud detection) and the constraints (skills gaps, bias, privacy/cybersecurity, and regulatory uncertainty), emphasizing education and ethical governance as prerequisites for sustainable implementation (Alruwaili & Mgammal, 2025).

1) What practitioners report: adoption is a pathway, not a switch:

In a survey-based empirical study, Mgammal (2024) models AI adoption in accounting as a sequence of linked relationships—moving from awareness and usage to AI engagement, then to changes in accounting procedures, and finally to accounting efficiency. The implication is clear: awareness alone is insufficient; value appears when organizations convert awareness into engaged use that materially reshapes workflows and controls (Mgammal, 2024).

Why this matters for the research community:

If we want to predict real-world outcomes, research designs should measure “engagement and workflow redesign” rather than stopping at generic intention-to-use constructs.

2) What academics add: capability-building and governance determine sustainability:

From an academic perspective, Alruwaili and Mgammal (2025) position AI adoption within Saudi Arabia’s broader transformation objectives and show that AI is perceived as capable of streamlining operations and enabling knowledge-intensive tasks in accounting. At the same time, they foreground constraints that are particularly consequential for the profession: skills and training gaps, ethical concerns (including bias), privacy/cybersecurity exposure, and regulatory/oversight readiness (Alruwaili & Mgammal, 2025).

Why this matters for editors and reviewers:

Manuscripts that treat governance, ethics, and regulation as peripheral “limitations” will likely miss the determinants of adoption quality in accounting environments where accountability, auditability, and compliance are core.

3) A responsible adoption roadmap (synthesis of both studies):

Taken together, the two studies suggest a socio-technical roadmap:

-

Build AI literacy and role-based capability (professional training; curriculum modernization) (Alruwaili & Mgammal, 2025; Mgammal, 2024)

-

Design human-in-the-loop workflows (clear accountability, exception handling, audit trails) (Mgammal, 2024)

-

Institutionalize ethical governance (bias controls, privacy and cybersecurity safeguards, transparent oversight) (Alruwaili & Mgammal, 2025)

-

Align adoption with measurable outcomes (efficiency, assurance quality, fraud/anomaly detection performance, compliance consistency) (Alruwaili & Mgammal, 2025; Mgammal, 2024)

4) Research questions worth prioritizing next:

For authors working at the intersection of AI, accounting, and policy, these questions are strongly motivated by the two studies:

-

Which dimensions of AI engagement (frequency, task criticality, trust, explainability needs) best predict efficiency and assurance outcomes (Mgammal, 2024)?

-

What governance designs most effectively mitigate bias and privacy/cyber risk without slowing beneficial adoption (Alruwaili & Mgammal, 2025)?

-

What education and professional-development interventions best prepare the accounting workforce for AI-augmented roles (Alruwaili & Mgammal, 2025; Mgammal, 2024)?

References:

Alruwaili, T. F., & Mgammal, M. H. (2025). The impact of artificial intelligence on accounting practices: An academic perspective. Humanities and Social Sciences Communications, 12, 1197. https://doi.org/10.1057/s41599-025-05004-6

Mgammal, M. H. (2024). The influence of artificial intelligence as a tool for future economies on accounting procedures: Empirical evidence from Saudi Arabia. Discover Computing, 27, 20. https://doi.org/10.1007/s10791-024-09452-7

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in