As I discussed in my last post, the key strategic issues facing biotech start-ups are capital constraint, regulatory burden and the need for complementary assets and credibility. Together, with project specific factors such as market opportunity and competition, they shape decisions about what, when, and how a firm plugs into the value chain. These decisions are captured in the firm’s business model. Over my next few posts I am going to explore the implications and trade-offs that surround each of these strategic decisions, beginning with what.

What describes the final product offering that a company expects to be marketed. In the pharmaceutical sector this vision for the product is described in the “target product profile,” which includes the desired therapeutic indications, dosage form, strength and route of administration. When embarking on a new product development project there may be many decisions that have to be made about exactly what form the innovation is going to take when it comes to market. For example, in the case of a product for relieving pain, what will need to differentiate between acute pain and chronic pain, the type of underlying disease to be targeted (e.g. cancer pain or lower back pain), the degree of pain (mild, moderate, severe) and the presentation of the product (e.g. tablet, transdermal patch or injection).

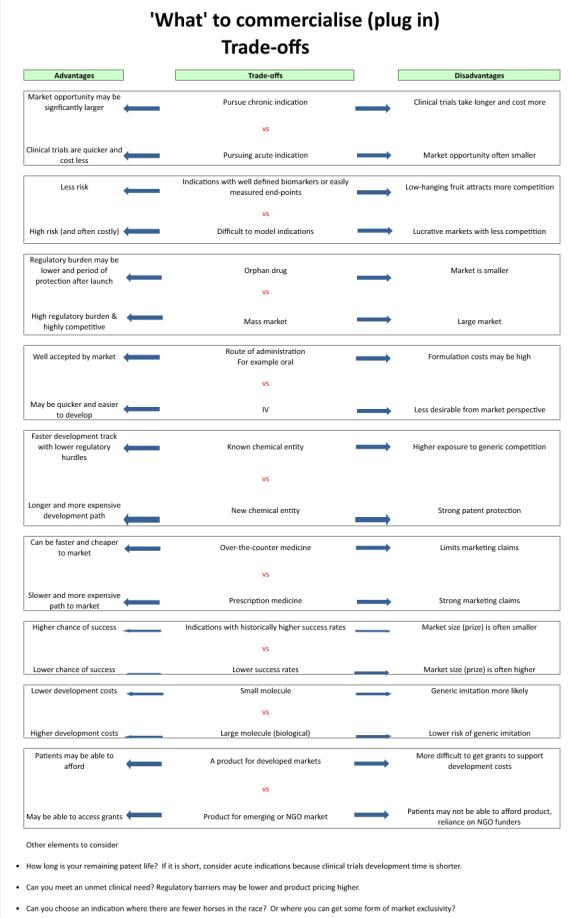

It is difficult to provide pre-emptive advice about what to bring to market, due to the vast range of unique development projects. However, in evaluating alternatives, there are often trade-offs to consider. The following table outlines typical trade-offs that drug development companies may have to face.

Some of the factors to consider when deciding amongst this long list of trade-offs are the size of the market, the level of competition, regulatory barriers, pricing and reimbursement, and remaining patent life.

Time is an important driver of what choices from several perspectives. Firstly, what is the length of the firm’s intellectual property protection? (Patent protection usually expires 20 years after an initial patent filing.) The typical development time for a new drug is around 12 years, so it’s not hard to see that the shorter the remaining patent protection, the stronger the bias toward drugs that can be brought to market quickly. Factors such as the length of clinical trials for different indications or the availability of regulatory exclusivity become critical. Another consideration is how quickly you can get to market with a niche indication, allowing you to generate revenues for basic survival and for funding more potentially lucrative indications.

The choice of therapeutic area also brings different chances of success and is also typically associated with certain levels of costs and duration of clinical development. Figure 1 shows that anti-infective drugs are significantly more likely to pass phase I, II and III trials than cardiovascular, anti-cancer or nervous system drugs. However once drugs from these categories have been submitted for approval, they all have about 75-80% chance of making it to market.

Figure 1 Cumulative success rates to market by therapeutic area

Source: CMR International Institute for Regulatory Science

Figure 2 shows that drugs for infectious diseases tend to be cheaper and faster to develop while central nervous system (CNS) drug development projects tend to be expensive and lengthy in duration.

Figure 2 Mean clinical study time vs cost for selected therapeutic groups

Source: DataEdge, Tufts Center for the Study of Drug Development

Clearly, a firm may have many options over what to develop and decisions made early in the life of the company will have major implications down the track.

But wait, there’s more ….. strategic decisions about ‘when’ and ‘how’ a firm will interact with its value chain are also key components of the business model. Coming up in my next post!

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in