Key strategic choices – ‘when’ to plug into the value chain

Published in Bioengineering & Biotechnology

Companies must make many strategic decisions in developing a business model. My last post looked at key strategic choices about ‘what’ a company could develop, and it considered trade-offs and implications of decisions that greatly impact the risks, costs and rewards of drug development. This post looks at another important element of the business model – ‘when’ a company should plan to plug into the value chain and earn a return for its investors.

Typical mechanisms for plugging in include licensing, sale of the product, sale of the company, or sale of part of the company via an initial public offering (IPO), whereby investors receive a return. In theory, this can happen anywhere along the product development value chain, from idea/discovery to marketing a physical product to consumers – as long as a willing partner or buyer can be found. But actually, there are certain factors around a drug development opportunity that can enable or constrain the feasibility of investors receiving a return at various stages in the drug development process.

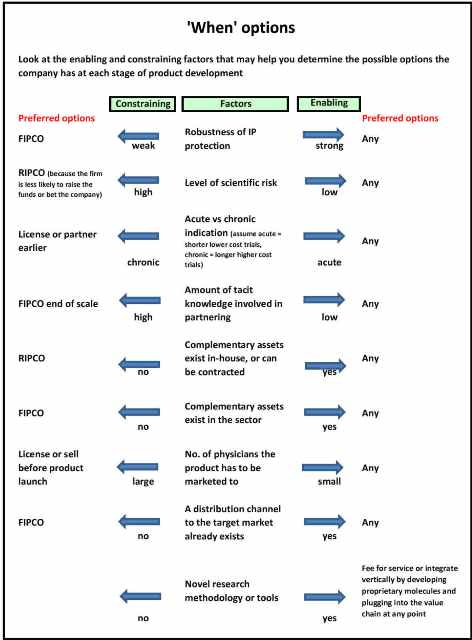

Take a look at Figure 1. The central column lists certain attributes (factors) of a drug development opportunity that, if enabling, will leave open a wide range of commercially viable options for when a company can plug into the value chain and take value off the table for investors. However, certain factors, if they are constraining, will point a firm to plug into the value chain at a specific point in the drug’s development path. Some constraining factors – such as high cost, high risk, and lack of internal skills or assets – will drive a company to plug in earlier on the development path.

Fig. 1

A RIPCO (royalty income pharmaceutical company) business model would then be typical. But other constraining factors, such as weak intellectual property protection, a high degree of in-house knowledge not easily transferred to a partner, or the need for specialised manufacturing assets, may drive a company toward plugging in at the other end of the value chain (selling a physical product). A FIPCO (fully integrated pharmaceutical company) business model might then be appropriate. In an earlier post I provided a diagram showing the parts of the value chain covered by commonly employed business models in the drug development industry.

Access to capital has to be one of the most common constraints in the sector. Without a doubt, capital constraint will drive a company toward plugging in earlier. However, I purposely left finance out of Figure 1, as I did not want firms to perceive this constraint as large enough to keep them from thinking about what their ideal business model would be if they did have adequate access to capital.

Firms may have more options than they think they have. As you progress down the development path, building value and reducing uncertainty, financing opportunities may emerge that were not available to you before. I’m a big fan of keeping options open, but in order to do that, you need to recognise those options exist in the first place. Real Options Reasoning (ROR) is an approach to strategy that involves identifying and nurturing options, and it fits very well with the biotech sector since the development of a drug occurs in a series of reasonably discreet steps that favour option-like investments. I might talk about ROR in a future post, but over the next couple of months we’ve still got ‘how’, ‘where’, ‘who and ’for whom’ to discuss…. a biotech start-up has a lot of strategic decisions to face!

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in