Leveraging NFTs for Sustainable Urban Finance – Insights from Our Latest Research

Published in Social Sciences and Earth & Environment

Explore the Research

elsevier.com

elsevier.com

Just a moment...

Skip to main content

Introduction

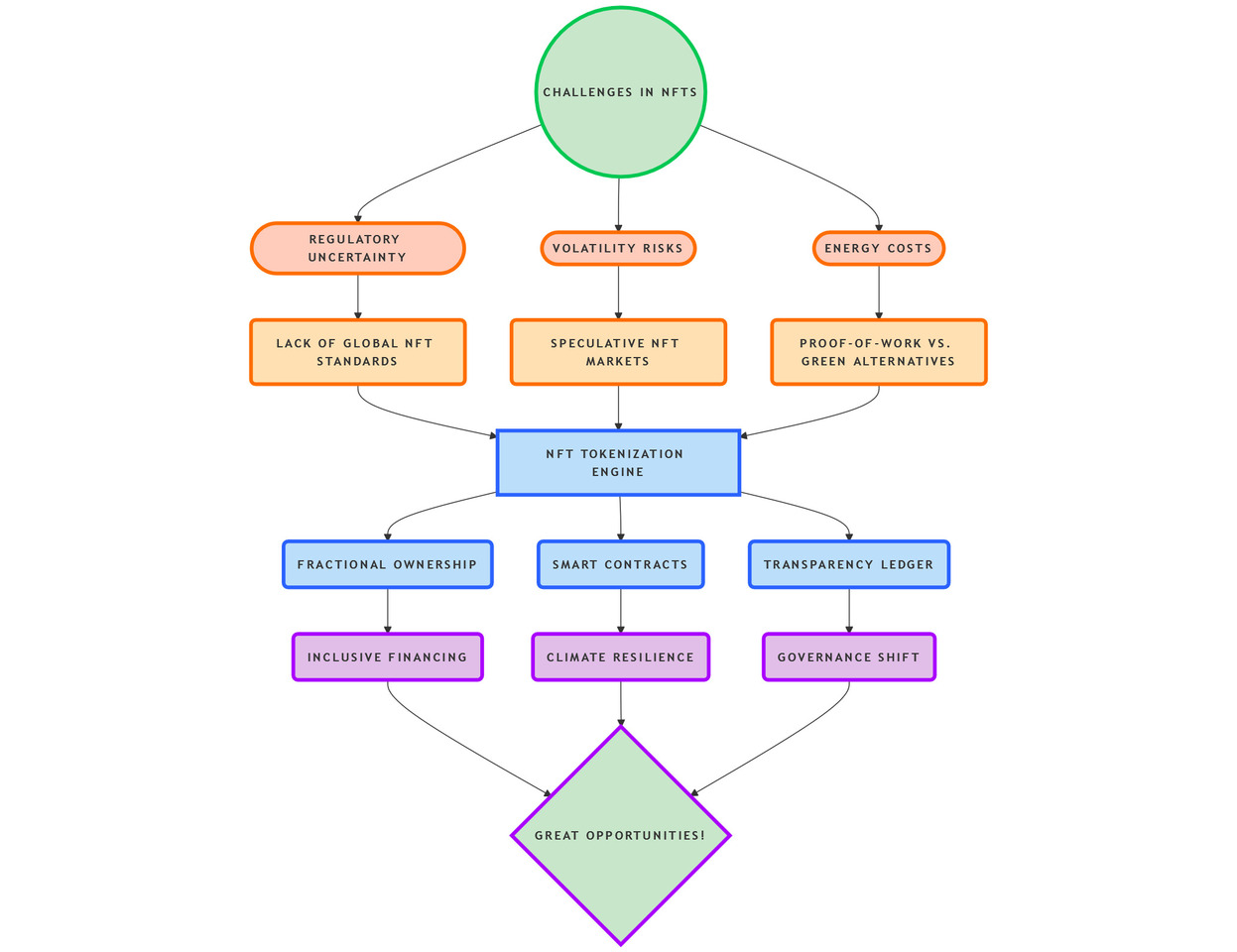

Cities around the world are grappling with unprecedented challenges—rapid urbanization, crumbling infrastructure, and climate change—all exacerbated by limited funding, especially in developing nations. Traditional financing mechanisms like taxes and loans are no longer sufficient. In our recent study published in Cities, titled "Leveraging NFTs for Sustainable Urban Finance: Challenges and Opportunities for Smart Cities," we explore how Non-Fungible Tokens (NFTs) can revolutionize urban finance by democratizing investment, enhancing transparency, and fostering resilient, inclusive smart cities.

The Promise of NFTs in Urban Finance

NFTs, often associated with digital art, are now emerging as powerful tools for urban development. By tokenizing real-world assets like real estate, public transit, or renewable energy projects, cities can unlock new funding streams and engage citizens as stakeholders. Here’s how:

-

Tokenization of Urban Assets

NFTs enable fractional ownership of infrastructure projects, allowing small investors to participate. For example, affordable housing in Mumbai or solar grids in Tokyo could be tokenized, pooling capital from a diverse range of contributors. -

Transparency and Trust

Blockchain’s immutable ledger ensures that every transaction is traceable, reducing corruption and boosting public confidence in municipal projects. -

Public-Private Partnerships (PPPs)

NFTs decentralize funding, enabling dynamic collaborations between governments, private entities, and citizens. Case studies from Dubai and Medellín show how NFT-based models have successfully funded real estate and public transit.

Challenges to Overcome

While NFTs offer transformative potential, their adoption faces hurdles:

-

Regulatory Uncertainty: Most countries lack clear legal frameworks for NFT ownership, taxation, and enforcement.

-

Market Volatility: Speculative bubbles could destabilize long-term urban projects.

-

Environmental Impact: Energy-intensive blockchains like Ethereum conflict with sustainability goals, though greener alternatives (e.g., Ethereum 2.0) are emerging.

Key Takeaways for Policymakers

Our research underscores the need for:

-

Clear Regulations: Governments must establish sandbox policies (like Singapore’s) to test NFT-based municipal bonds.

-

Sustainable Tech: Prioritizing low-energy blockchains (e.g., Polygon, Algorand) to align with climate goals.

-

Public Education: Demystifying NFTs for citizens to foster participation and trust.

The Road Ahead

NFTs are more than a buzzword—they’re a paradigm shift in urban finance. By addressing regulatory, technical, and social barriers, cities can harness this technology to bridge funding gaps, empower communities, and build climate-resilient infrastructure.

Read the full study here (link to article) and join the conversation on how NFTs can shape the future of smart cities!

Authors: Ehsan Dorostkar & Keramatollah Ziari

Published in: Cities, Elsevier (2025)

#UrbanFinance #NFTs #SmartCities #Blockchain #Sustainability #Innovation

What are your thoughts? Could NFTs be the key to financing your city’s next big project? Share your comments below!

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in

Fascinating work — this paper highlights how NFTs could evolve beyond collectibles into instruments for inclusive urban development. The intersection of blockchain, sustainability, and urban finance offers immense potential for resilient city ecosystems.