Unlocking the power of dynamic tariffs in the retail electricity market

Published in Earth & Environment

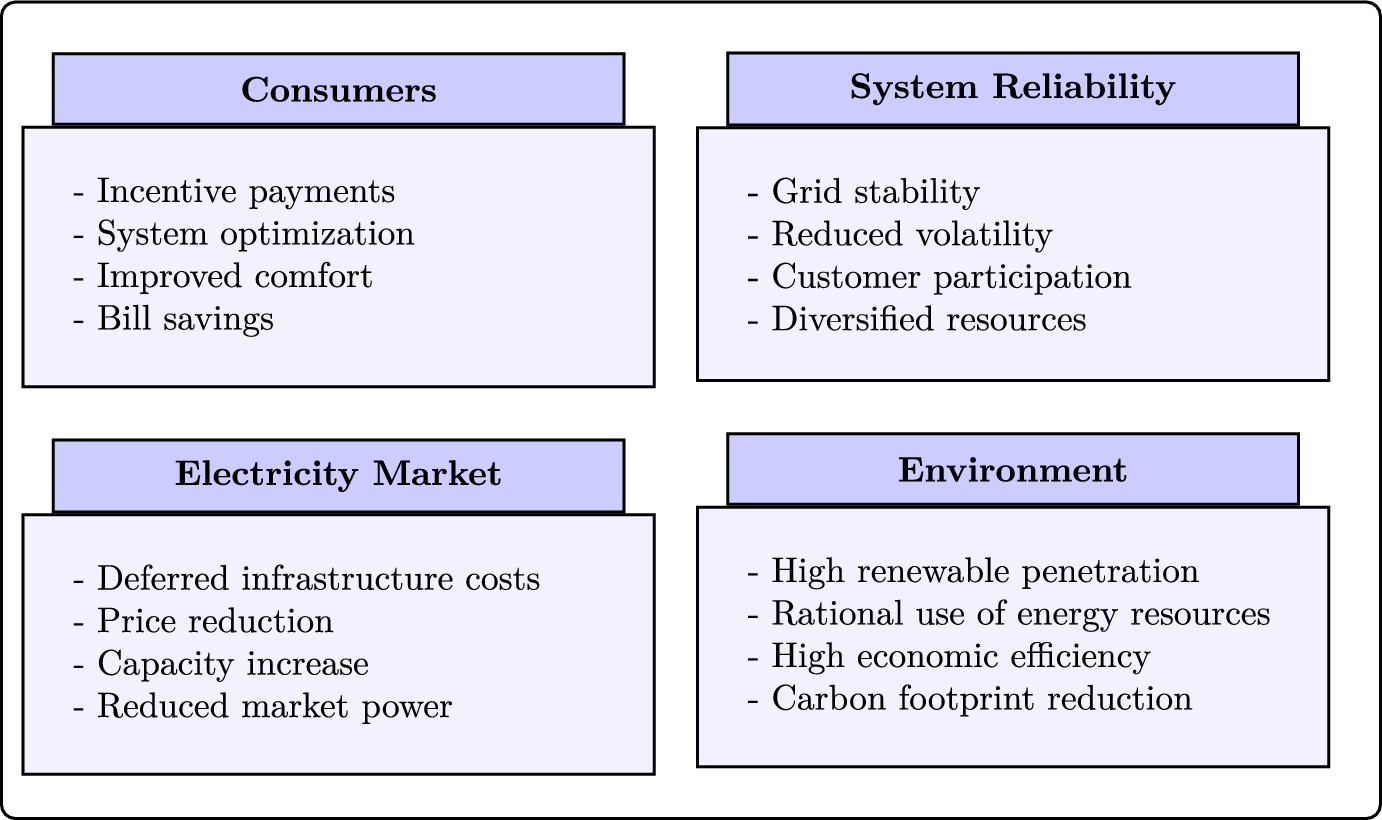

Electricity markets face growing uncertainties due to the high integration of renewable energy sources (RES), fluctuating demand, and market power dynamics. Retailers and consumers must navigate these complexities while ensuring economic efficiency, reliability, and sustainability.

Demand response programs have become a great resource for end-users to optimize their flexibility while maximizing their benefits based on incentives or price reductions. They also bring supply security and reduce uncertainty bound to electricity markets. These methods are prominent in short-term electricity markets involving different market participants.

Our recent study presents a game-theoretical model that captures the strategic interaction between electricity retailers (leaders) and consumers (followers).

Approach:

1️⃣ We proposed dynamic tariff-based demand response programs under uncertainty using bilevel programming (Stackelberg game).

2️⃣ Explored two market configurations:

-Market Power: A retailer with market power that maximizes its expected profit and competitive consumers that minimize their cost of electricity consumption.

-Perfect Competition: Competitive equilibrium between retailers and consumers.

3️⃣ Applied stochastic programming to model uncertainty and utility function to quantify consumers' behavior to shift/reduce their electricity consumption.

Using advanced optimization techniques, we formulate these problems as a mathematical program with equilibrium constraints (MPEC) and a mixed-integer linear program (MILP). We derive tractable reformulations using the Karush-Kuhn-Tucker (KKT) conditions and validate our approach through numerical simulations based on real European Energy Exchange (EEX) data. We Tackle nonconvexity in the MPEC model using an NLP solver in KNITRO and a multistart strategy to identify high-quality solutions without linear approximations.

📊 Some results:

1️⃣Market structure significantly affects consumer flexibility and the demand response program's efficiency.

2️⃣Tariff-based demand response offers substantial cost savings in a competitive market structure and boosts market efficiency if consumers' decision is explicitly modeled.

3️⃣ Empowering and exploiting consumer flexibility is key to sustainable and resilient electricity markets.

Our study contributes to the evolving discourse on electricity market design and demand response strategies. We can move towards a more efficient, sustainable, and resilient electricity market by leveraging dynamic tariffs and consumer flexibility.

For the full publication, visit DOI: 10.1007/s00291-024-00802-x.

We welcome discussions, collaborations, and feedback from the research community, policymakers, and industry stakeholders. Let’s work together to optimize electricity markets for a sustainable future!

Follow the Topic

-

OR Spectrum

OR Spectrum publishes applied and theoretical articles, contributing to Operations Research as a scientific tool.

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in