Disagreement is diversity: ESG ratings of US water stocks diverge depending on the subsector

Published in Sustainability

Investments in companies are typically a combination of debt (loans and bonds) and equity (stocks). These investments provide capital that a company can then use to grow its business and, in turn, distribute profits (dividend) to its investors. Increasingly, investors rely on ESG (environmental, social, and governance) ratings to inform their investment decisions.

ESG scores, provided by rating agencies, evaluate a company’s performance with respect to ESG issues. Nonetheless, the evidence is now clear that the scores provided by ESG rating agencies disagree significantly across sectors. It remains unclear, however, if and how ESG ratings diverge in subsectors, for example, within the water sector.

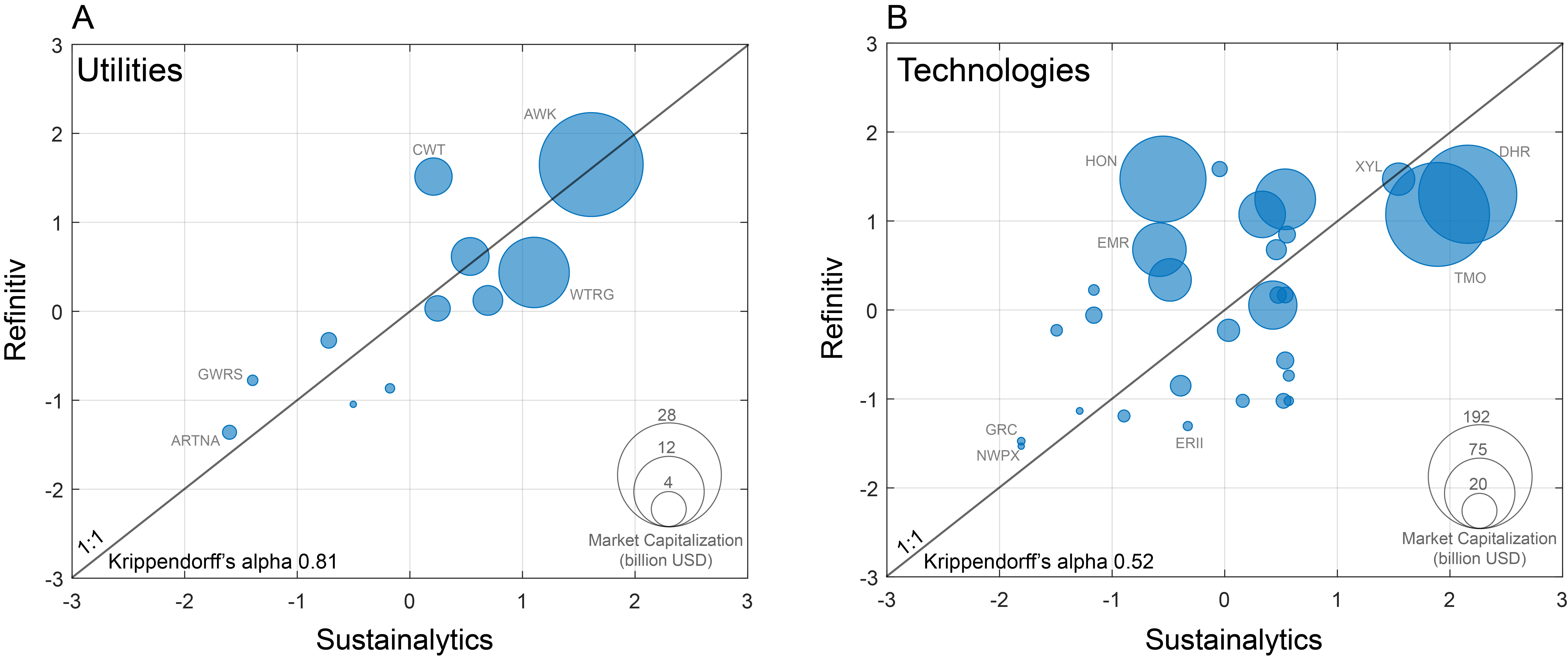

Against the backdrop of achieving the targets under SDG 6 (Clean Water and Sanitation), the flow of capital to firms within the water sector is vital. Governments and development finance institutions (e.g., World Bank, Asian Development Bank, etc.) can only achieve so much. Private sector involvement (utilities, technology providers, etc.) increasingly becomes important. The flow of capital towards firms in the water sector, however, is becoming more and more influenced by the ESG ratings that they receive. This is problematic because ESG ratings are now widely known to diverge (i.e., disagree) significantly with each other. The figure below shows an example of ESG divergence for two subsectors in the US.

In a recent contribution to The London School of Economics and Political Science (LSE) USAPP - American Politics and Policy, I show that:

1️⃣ ESG ratings disagree more strongly in the water technologies subsector (companies that manufacture and assemble water and wastewater treatment systems technologies) than in the water utilities subsector (companies that provide bulk or retail water supply and wastewater treatment services for cities).

➡➡ This suggests that the ESG issues confronting a firm that provides water supply and wastewater treatment services may be different from the ESG issues confronting a firm that provides the technologies for those services.

2️⃣ Better ESG performance is associated with large firms in the utilities subsector, but the same could not be suggested regarding large firms in the technologies subsector.

➡➡ This raises caution in suggesting sweeping implications between ESG performance and firm size at the subsector level.

ESG ratings and the US water subsectors

Figure 1 — The divergence in ESG ratings of two ratings agencies, Refinitiv and Sustainalytics, for publicly traded companies in the Utilities and Technologies subsectors in the US water sector. Sustainalytics’ scores were multiplied by -1 and added 100 to allow for comparison. That is, higher values correspond to better ESG performance. I then normalized the scores to have zero mean and unit variance. Ratings were retrieved between Nov 1 and Dec 2, 2022. Krippendorff’s alpha is a measure of inter-rater reliability. Krippendorff suggests α ≥ 0.80 as a customary threshold that the raters’ assessments are reliable; whereas α ≥ 0.667 is the lowest limit where tentative conclusions may be made. Following the taxonomy of Global Water Intelligence, the Utilities subsector includes companies that provide bulk or retail water supply and wastewater treatment services for cities. Technology subsector includes companies that manufacture and assemble water and wastewater treatment systems, including companies that provide components for these systems. symbols of some stocks are shown. (Author’s analysis)

Disagreement is diversity

The interpretations of these findings [using Global Water Intelligence (GWI)'s taxonomy] assume that there is meaningful information in the ratings despite their disagreement. And that US water sector players could and should still find value in using ESG information for their purposes.

The US water sector has approximately 50,000 utility providers. But only a tiny fraction of these is publicly listed. As the sector consolidates, against the backdrop of growing importance being placed on ESG ratings, these findings point to the need for greater scrutiny over how the data behind ESG ratings are generated. It also underlines some nuances between different subsectors. If for-profit firms are to maximize their success and their contributions to repairing and replacing the country’s drinking water infrastructure, then paying close attention to these nuances may be all worth the effort.

Full analysis is available here.

Photo ©iStock/Water drop phive2015

Follow the Topic

What are SDG Topics?

An introduction to Sustainable Development Goals (SDGs) Topics and their role in highlighting sustainable development research.

Continue reading announcement

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in