Would you accept a digital currency from the central bank? AI already has an answer

Published in Economics

As physical money loses prominence and the use of digital means of payment grows, central banks around the world have begun to investigate -and in some cases implement- their own digital currencies. These seek to modernize payment systems, reduce transaction costs, increase security and foster financial inclusion. Countries such as the Bahamas (with the Sand Dollar), Nigeria (e-Naira) or China (e-CNY) have already taken firm steps in this direction.

However, their mass adoption will depend on one key factor: public acceptance. How willing are citizens to abandon cash and adopt a state-issued digital currency?

Artificial intelligence at the service of the economy

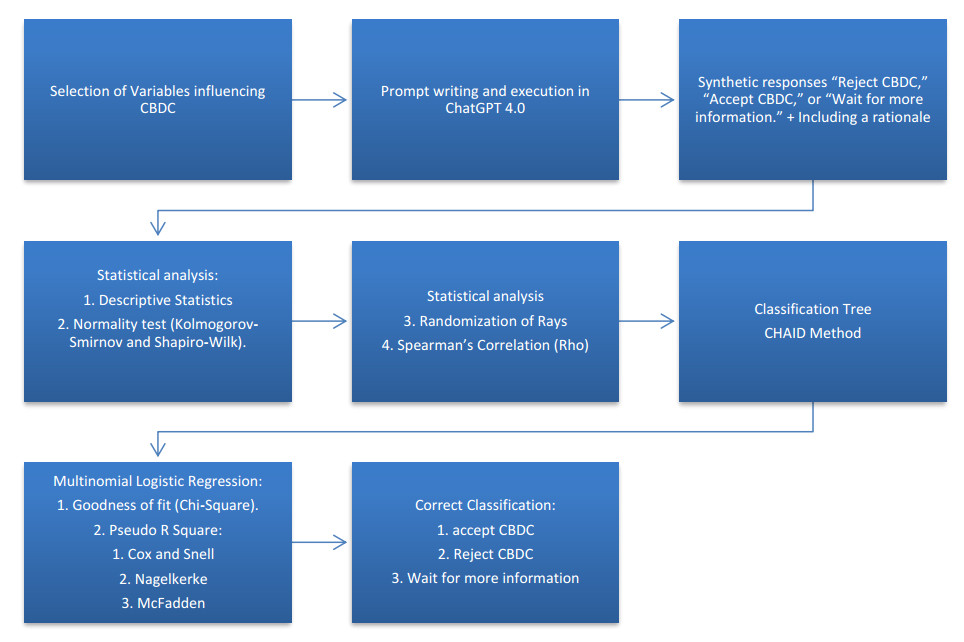

To answer this question, the study used an unconventional approach: it generated 663 synthetic responses using artificial intelligence (ChatGPT 4.0), mimicking how real people might react to the arrival of a CBDC. These responses simulate different demographic profiles (age, gender, education, income, etc.) and variables such as the influence of friends, media, financial experience and merchant acceptance.

The methodology employed-which includes statistical techniques such as logistic regression and CHAID models-allowed us to identify behavioral patterns in the “simulated users”.

What factors influence acceptance?

The study reveals that the social environment (what friends and family think), the individual's financial identity and sources of information are the most important determinants in deciding whether to accept or reject a CBDC. For example:

If a close friend rejects CBDC, it is very likely that the individual will also reject CBDC.

Cryptocurrency enthusiasts are the most skeptical of CBDCs.

People with no financial experience tend to wait for more information before making a decision.

Younger users, and those more connected to social networks, are more likely to be open to the idea, albeit cautiously.

In contrast, variables such as gender or income level showed less impact on the decision.

How reliable are the results?

Although the data are simulated, the study shows that the patterns obtained coincide with previous research conducted with real people. The accuracy of the CHAID model reached 92.6%, while logistic regression correctly predicted 96.4% of the cases, especially in the “reject” or “wait for more information” decisions.

However, the authors caution that such simulations cannot capture all the complexities of real human behavior. Emotional, historical or cultural factors are not always replicable by artificial intelligence models.

A more inclusive digital future?

Using artificial intelligence to anticipate how the population might behave in the face of CBDC offers central banks a powerful tool to plan more informed public policies. It also raises new challenges: how to communicate the benefits of digital currency, which social groups might be left behind, how do you balance privacy with traceability?

While many questions remain open, the potential of CBDCs to transform the economy is enormous. Their success, however, will depend not only on the technology, but on public trust and perception. As the study suggests, understanding these dynamics from the outset could make all the difference.

Source: “Evaluating the acceptance of CBDCs: experimental research with artificial intelligence (AI) generated synthetic response”. Sergio Luis Náñez Alonso, Peterson K. Ozili, Beatriz María Sastre Hernández and Luís Miguel Pacheco. Quantitative Finance and Economics, 2025. https://doi.org/10.3934/QFE.2025008.

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in