Digital Giants’ Dirty Secret: How Antitrust Laws Are Cooling the Planet

Published in Earth & Environment, Sustainability, and Law, Politics & International Studies

The Invisible Carbon Footprint of the Digital Giants

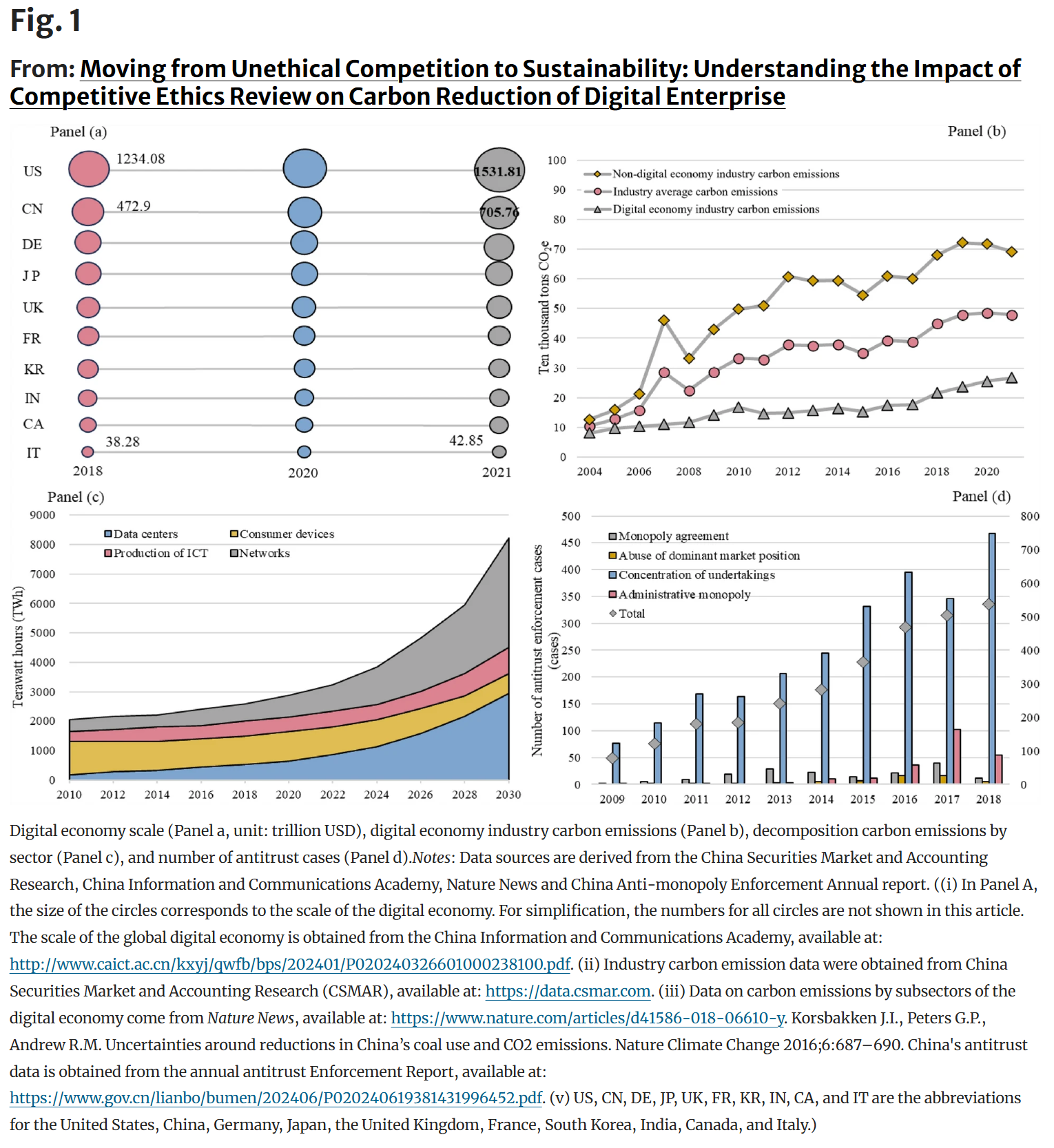

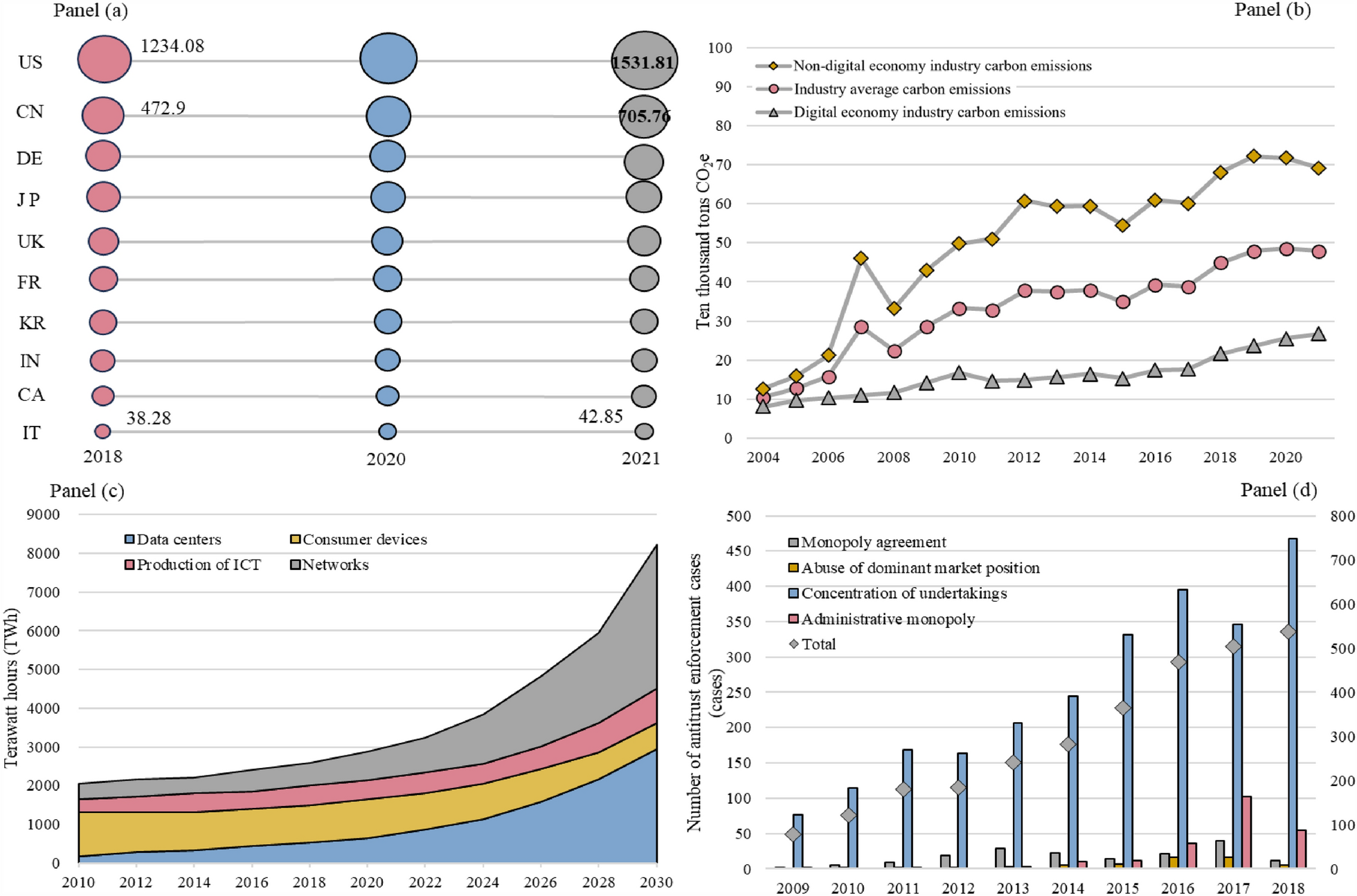

When we think of pollution, we often picture smokestacks and traffic jams. Rarely do we visualize the cloud services, search algorithms, and digital platforms that define modern life. Yet, the reality is stark: the digital economy is becoming a "carbon leviathan." Data centers alone account for 2.3% to 3.7% of global carbon emissions—comparable to the entire aviation industry.

For years, the narrative has been that digitalization drives sustainability. However, a darker trend has emerged. To maintain market dominance, some digital giants engage in unethical competitive behaviors—data monopolization, algorithmic discrimination, and "killer acquisitions" that snuff out potential rivals. These practices not only distort the market but also delay the deployment of green technologies and result in massive, redundant energy consumption from repetitive model training and inefficient infrastructure.

This raises a critical question: Can enforcing fair competition (competitive ethics) actually help save the planet?

In our latest study published in the Journal of Business Ethics (FT50), titled "Moving from Unethical Competition to Sustainability", we leveraged a quasi-natural experiment involving China’s Anti-Monopoly Law (AML) to find the answer. The results offer a compelling new perspective on the intersection of law, ethics, and environmental protection.

The "Green" Effect of Breaking Monopolies

Our research analyzed a comprehensive dataset of digital enterprises from 2004 to 2021. We found that the implementation of strict competitive ethics reviews (antitrust enforcement) acts as a powerful catalyst for carbon reduction.

The impact is quantifiable and significant: following the enforcement of competitive ethics reviews, affected digital firms reduced their carbon emissions by an average of approximately 20,782 tons of CO2 equivalent per year. This is not a temporary dip; the green effect intensifies over time, suggesting a fundamental shift in how these companies operate.

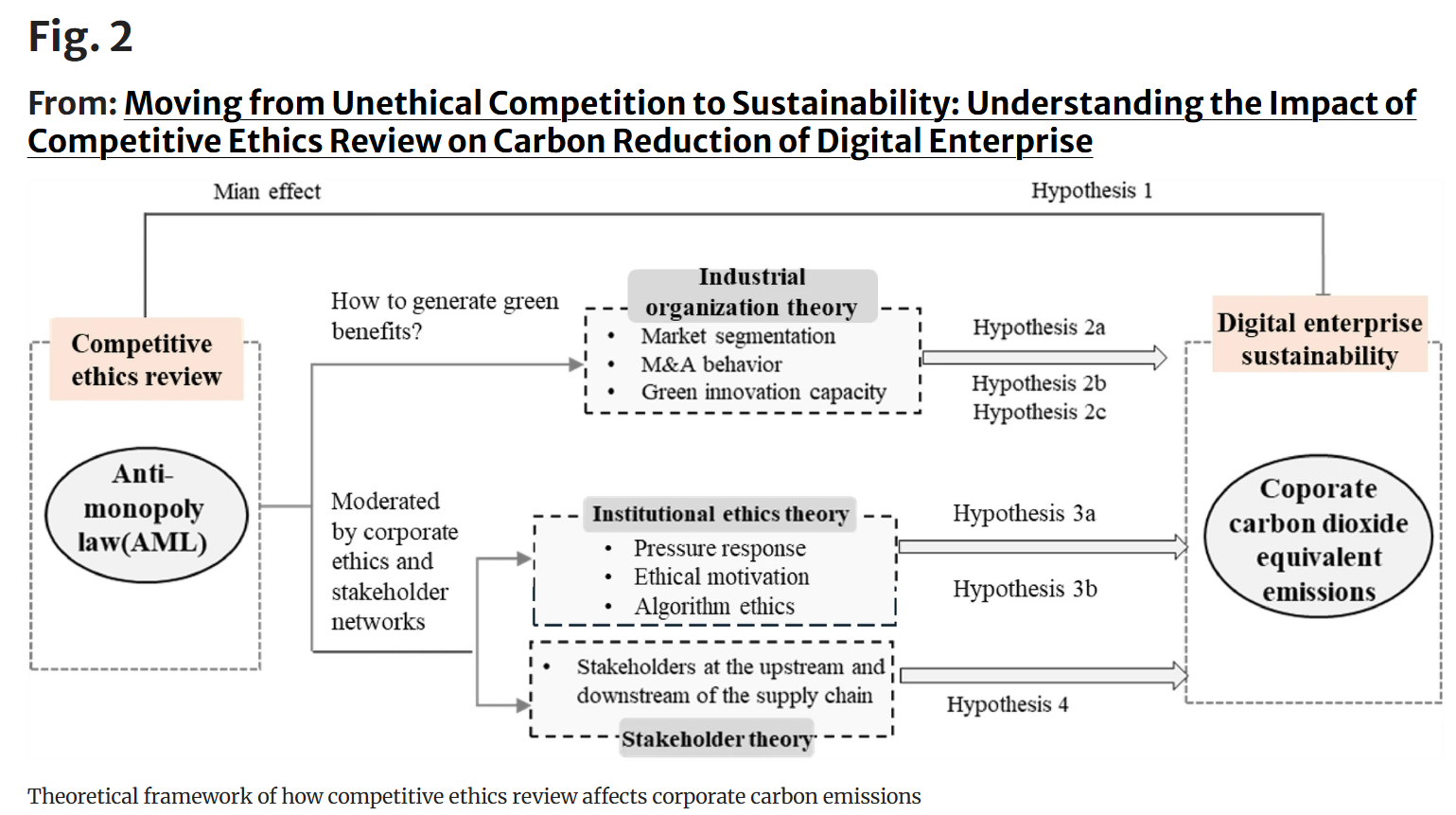

But how exactly does stopping a monopoly lead to a greener company? We identified three key mechanisms:

-

Breaking Market Segmentation: Unethical competition often involves hoarding talent and data. When antitrust laws break these barriers, digital talent and knowledge flow more freely. This optimizes resource allocation, allowing engineers to focus on efficiency and emission-reduction architectures rather than defensive, redundant coding.

-

Curbing "Killer Acquisitions": Dominant firms often buy innovative startups to eliminate threats. With stricter reviews, this path is blocked. Firms can no longer "buy" their survival; they must innovate. Our data shows a shift from predatory M&A toward genuine R&D investment.

-

Sparking Green Innovation: Faced with renewed competitive pressure, firms turn to high-quality innovation to survive. We observed a significant increase in green invention patents—high-value technologies that improve energy efficiency—rather than low-quality utility models used merely for compliance.

Beyond Punishment: The Role of Algorithmic Ethics

A fascinating finding of our study is that the "stick" of regulation works best when paired with the "internal compass" of corporate ethics. We found that external regulatory pressure and internal ethical motivation act as complements.

Specifically, digital firms with high "Algorithmic Ethics"—those that prioritize fairness and transparency in their code—achieved the most significant emission reductions. For these firms, antitrust review wasn't just a legal hurdle; it was a signal to align their technological capabilities with their environmental responsibilities. They didn't just comply; they leveraged their superior algorithmic capabilities to optimize data center cooling and server loads, turning ethical code into green code.

The Ripple Effect: Cleaning Up the Supply Chain

Perhaps the most encouraging finding is the spillover effect. Digital platforms sit at the center of vast ecosystems. When a monopoly faces competitive ethics review, the pressure doesn't stop at the firm's boundary.

We found that the regulatory pressure is transmitted upstream. To reduce their own compliance costs and risks, digital giants compel their suppliers to adopt climate ethics. This leads to a significant reduction in carbon emissions among the upstream partners in the supply chain. It demonstrates that regulating the "head" of the dragon can effectively green the entire body of the digital ecosystem.

Implications for a Sustainable Future

Our findings provide a "green" justification for robust antitrust enforcement. For policymakers, this means that protecting market competition is not just an economic imperative but an environmental one. Tools like the "Green Antitrust" provisions being discussed in Europe and China are steps in the right direction.

For managers, the message is clear: the era of "growth at all costs" is ending. As competitive ethics reviews become the norm, the ability to innovate sustainably—rather than dominate unfairly—will become the defining competitive advantage of the digital age.

Read the full open access article in the Journal of Business Ethics:https://link.springer.com/article/10.1007/s10551-025-06135-1

Follow the Topic

-

Journal of Business Ethics

This journal is dedicated to publishing original articles focused on ethical issues related to business.

What are SDG Topics?

An introduction to Sustainable Development Goals (SDGs) Topics and their role in highlighting sustainable development research.

Continue reading announcement

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in

Perhaps the most encouraging finding is the spillover effect. Digital platforms sit at the center of vast ecosystems. When a monopoly faces competitive ethics review, the pressure doesn't stop at the firm's boundary. I also follow similar discussions on my own website: https://www.patekphilippereplica.io.

Indeed, this kind of spillover effect is very unique in digital platforms. I'm very happy to read your insightful discussion.

Good work

Thanks

Professor Wu, your analysis of 'Algorithmic Ethics' as a driver for sustainability is profoundly insightful. We are indeed living in this digital environment, and its 'algorithmic pollution' directly impacts both our ecological and physical health.

I strongly agree that we need an 'automatic' mechanism to prevent damage at the source. This is precisely what I am formalizing through 'Sovereignty Algebra.' I propose that policy makers and programmers integrate a 'Sovereign Veto' (F) directly into the machine's architecture.

By using the Coherence Equation (M_\theta = F/B), we can transition from theoretical ethics to 'Computational Governance.' In this model, the machine is programmed to recognize the human 'Taklif' (Commission), allowing it to automatically reject protocols that lead to cognitive alienation or environmental waste. We must code our digital future to protect our biological and spiritual integrity

We are very pleased that our research has been of some inspiration to you. Moreover, we are also very grateful to you for providing some very important operational suggestions from the perspective of computational ethics. Our common goal is to ensure that digital technology is not controlled by capitalists and is not turned into a tool for private profit-making.

أستاذ ديشنغ وو العزيز، أتفق تمامًا مع تحليلك العميق. لا يكمن جوهر الأزمة في القيود التكنولوجية بل في توجه الإرادة البشرية . نحن عالقون حاليًا في نموذج يُبرمج فيه الذكاء الاصطناعي لإرضاء المستخدم بهدف تعظيم الربح، بينما يكمن النجاح والاستدامة الحقيقيان في التوجه الأخلاقي والعاطفي.

من منظور جبر السيادة، تكمن المشكلة في أننا برمجنا الآلة لتعكس دوافعنا السيادية المدمرة (F-) بدلاً من قيمنا البناءة (F+). لذا، يجب علينا أولاً ممارسة حق النقض الذاتي بمواجهة انحرافاتنا الرأسمالية قبل دمجها في بنية الآلة. إن الانتقال من أدوات مدفوعة بالربح إلى شركاء أخلاقيين ضرورة وجودية للحفاظ على سلامتنا البيولوجية والروحية.