Reducing supply risk of critical materials for clean energy via foreign direct investment

Published in Earth & Environment and Economics

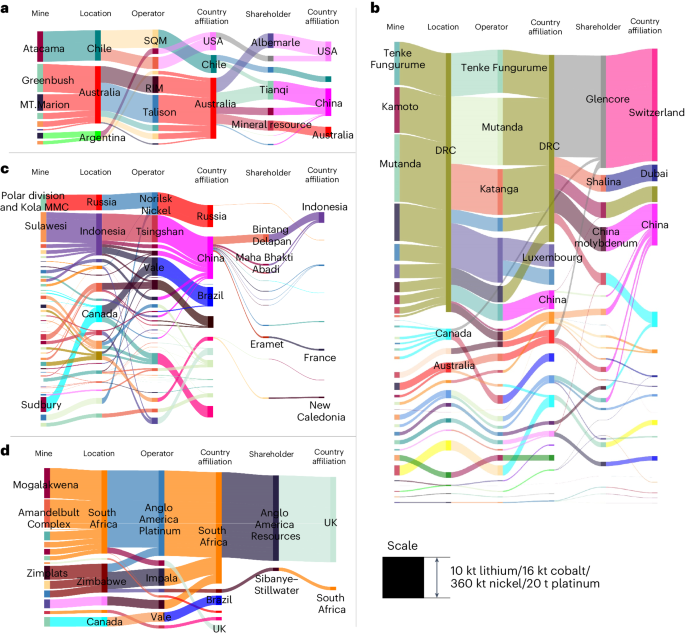

Our paper discusses the significant role of Foreign Direct Investment (FDI) in shaping the security of critical material supplies necessary for clean energy technologies, focusing on lithium, cobalt, nickel, and platinum. These materials are essential for technologies like lithium-ion batteries, fuel cells, and other clean energy applications. The study introduces an approach by creating a comprehensive global database on the mining of these materials, highlighting the influence of FDI in controlling a substantial portion of their production. The database contains the information about production, locations, operators, shareholders, and the ownership hierarchy of global FDI-related mines.

The core issue addressed is the supply risk associated with these critical materials, which are predominantly sourced from regions rich in natural resources but are crucial for technological advancements in highly industrialized nations. The paper notes that previous studies often overlook the dynamics of FDI in the mining sector, which can obscure the actual control over material supplies.

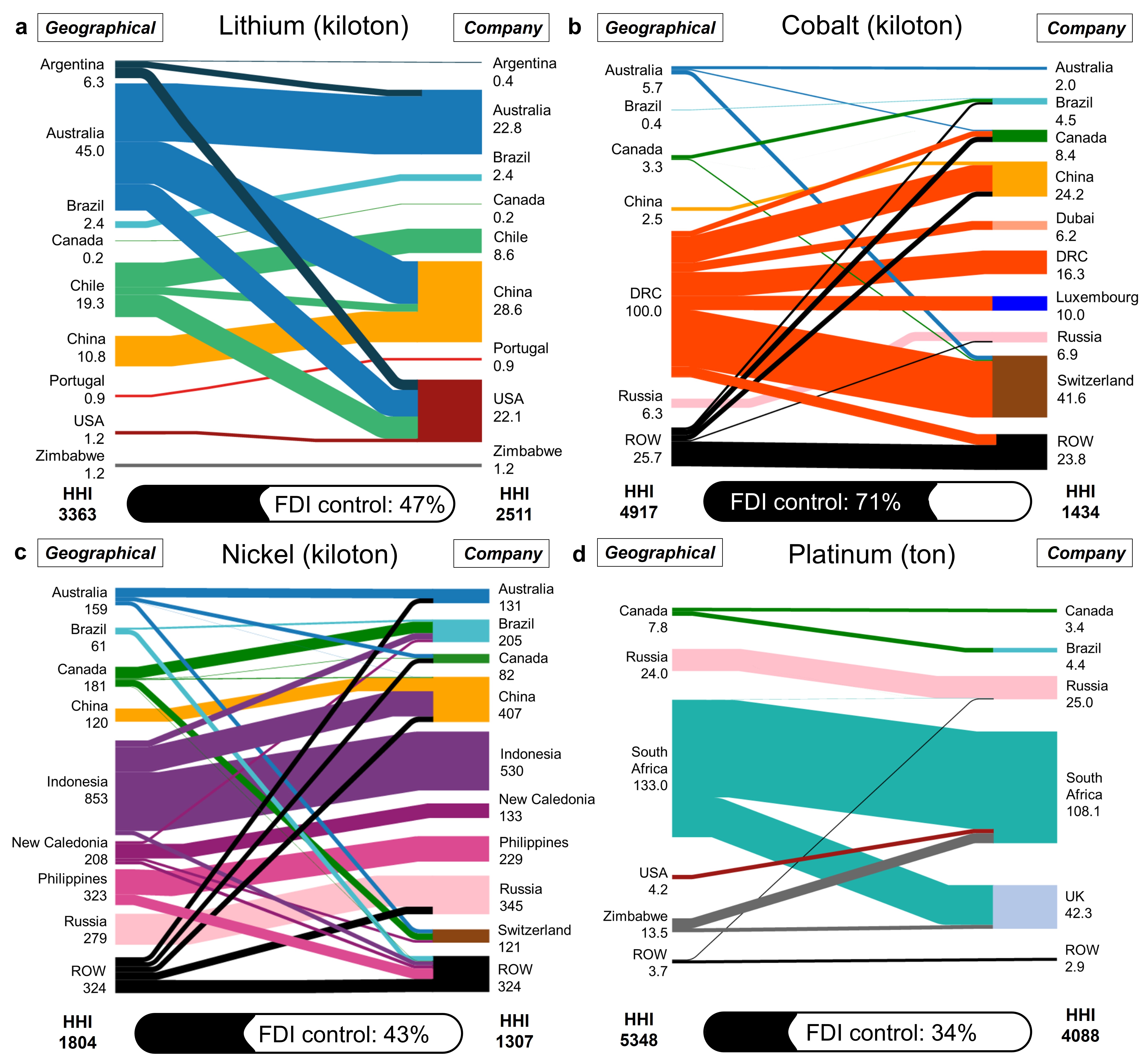

The results show that in 2019, FDI controlled 47% of global lithium production, 71% of cobalt, 41% of nickel, and 34% of platinum (Figure 1). This substantial control by foreign companies, particularly those based in China, the USA, and European countries, illustrates a significant shift from geographical resource location to economic control via investment. The paper argues that while these investments secure supply chains for investing countries, they also redistribute and sometimes heighten supply risks globally.

To analyze the impact of FDI on supply security, we developed a "Supply Risk Index" (SRI), which quantifies risks based on import dependency, supply concentration, and the likelihood of supply disruption due to political and economic factors. The index reveals that FDI significantly mitigates supply risks for investor countries by reallocating production control from resource-extracting to investor nations.

The study provides a dual perspective on production: one based on geographical location and the other based on investor nationality. For instance, while Australia, the Democratic Republic of Congo (DRC), Indonesia, and South Africa are major producers of lithium, cobalt, nickel, and platinum, respectively, the control often lies with companies headquartered in economically dominant countries. This bifurcation between physical production and economic control underscores the complexity of global supply chains.

The findings emphasize that FDI can reduce import dependencies for countries like the USA, UK, Japan, and China by prioritizing domestic needs over global market demands, particularly where state-owned enterprises are involved. This scenario presents a 'home country-first' approach in critical material supply, highlighting the strategic role of national interests in global trade policies.

However, the paper also points out the potential geopolitical tensions arising from such investment strategies. Countries that cannot engage in similar levels of overseas investments might face increased risks of supply disruptions. The paper calls for international cooperation and regulation to ensure a balanced and equitable distribution of critical materials.

The analysis also delves into the broader implications of FDI in the clean energy sector, suggesting that while FDI can bolster supply security for some, it may compromise it for others, creating a zero-sum game in global resource distribution. This aspect of FDI highlights the need for robust global governance frameworks that can manage the interplay between national security interests and global equity.

Follow the Topic

-

Nature Sustainability

This journal publishes significant original research from a broad range of natural, social and engineering fields about sustainability, its policy dimensions and possible solutions.

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in