What does it take for the global economy to go green?

Published in Social Sciences, Earth & Environment, and Mathematics

There is a widely accepted view, shared by scientists, policy makers, and the general public that addressing the climate crisis and sustainable development should go hand in hand. To achieve a transition to a green global economy whilst allowing for continued economic development, large shifts in the composition of global production and consumption are required. However, how and where such reallocation of resources should take place strongly depends on the underlying assumptions about the speed of the green transition. In this paper we consider three transition pathways, each defined by the speed of the shift from a fossil-fuel dominated economy (brown) to one dominated by renewable energy sources (green): constant (linear), fast, and delayed. We examine the requirements of each transition pathway in terms of capital and labor reallocation as well as investment in capital stocks and R&D. This allows us to draw conclusions regarding the main drivers of different transition pathways and general policy priorities.

Casting a green DICE

Computational models allowing for a joint depiction of economic and climate dynamics, known as integrated assessment models (IAMs), are the most widely used tools for exploring the possible economic repercussions of climate change, as well as the implications of limiting climate change using various policy mechanisms. The range of existing IAMs spans from fairly simple and stylised ones such as the influential DICE model, all the way to richly specified process-based IAMs such as WITCH, MESSAGEix or REMIND which include detailed representations of energy systems and can be linked with modules allowing for the analysis of issues such as land use or air pollution.

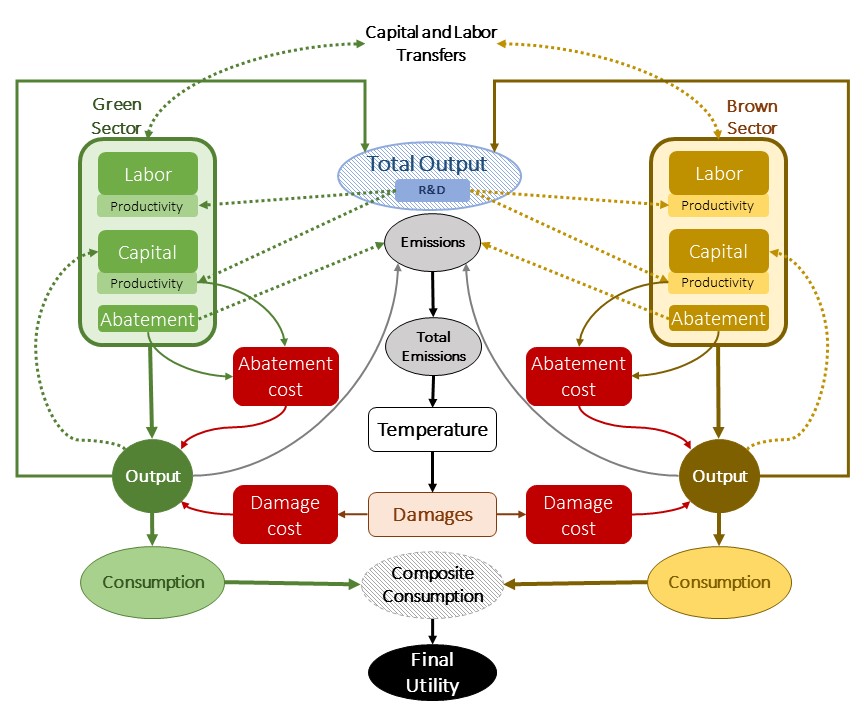

Our work uses the baseline DICE model as its point of departure and makes a number of key modifications and extensions which allow us to model the green transition in a stylized but meaningful way. In particular, our version of the model, summarized in Figure 1, consists of two productive sectors, one “green” and one “brown”. Capital and labor can, at a cost, be re-allocated between these two sectors. In addition, long-term productivity growth is driven by R&D efforts which must be divided between the two sectors.

Transitions are driven by an increasing share of “green” output in overall consumption, which the economy must accommodate through a combination of reallocation of capital and labor, capital accumulation in the green sector, and increased R&D efforts directed towards improving the productivity of labor and capital in the green sector. Being an intertemporal optimization model, the framework aims to find the least costly combination of measures for any given transition pathway, also taking into account both the cost of reducing emissions and the cost of climate damages stemming from unabated emissions in the past.

How will the green transition play out?

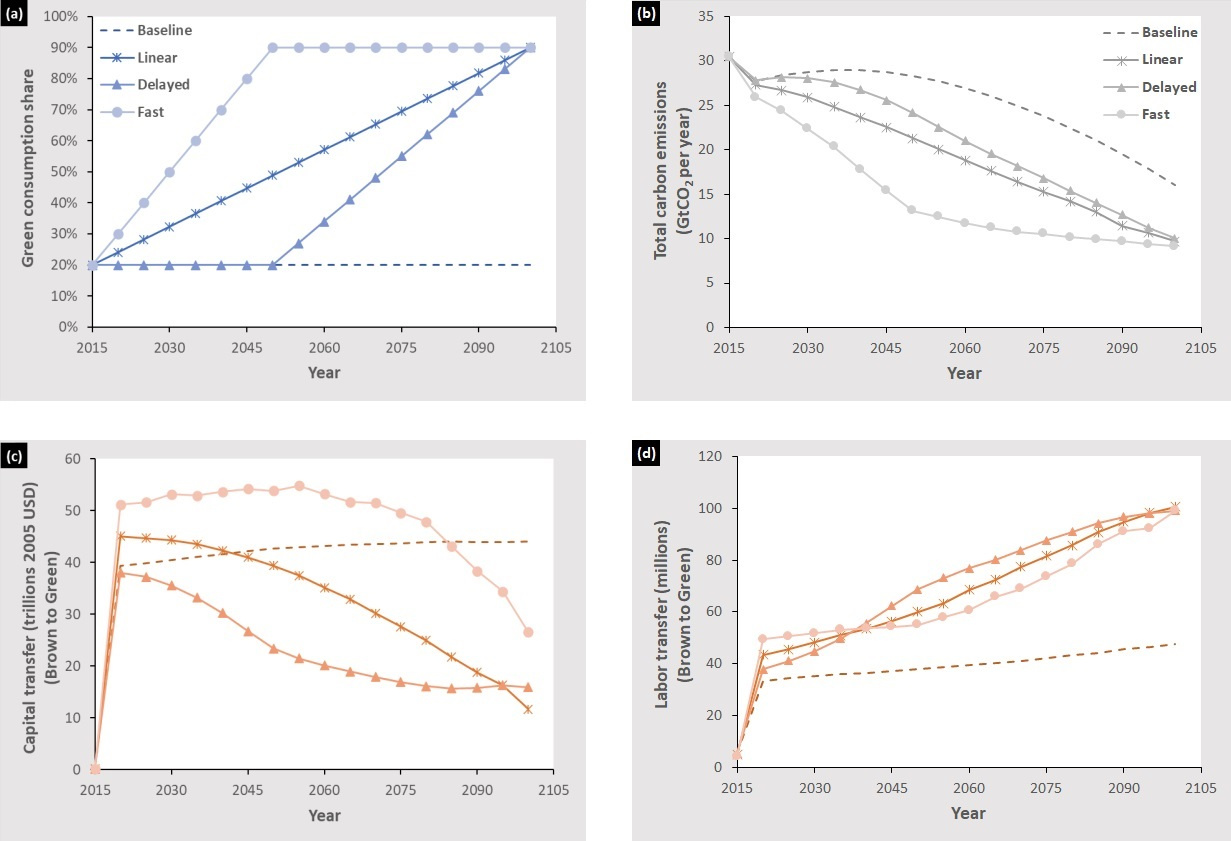

Comparing the implications of the different transition pathways illustrated in Figure 2a, the first implication of the speed of the transition is for the trajectory of CO2 emissions, shown in Figure 2b. Across scenarios, transitions are achieved through different combinations of factor transfers from the “brown” to the “green” sector and investments in green capital stocks and R&D. In particular, the fast transition pathway relies very heavily on transfers of capital from the “brown” to the “green” sector (Figure 2c) with labor reallocation being comparatively more limited and homogeneous across scenarios (Figure 2d). The fast pathway also requires substantial emission abatement efforts in the “brown” sector, which results in a sharp decline in emissions in Figure 2b. The slower pathways, meanwhile, feature a larger amount of investment and capital accumulation generated within the “green” sector itself, hence avoiding a part of the cost associated with reallocating capital across sectors. Importantly, we also find that, almost invariably across scenarios, a full allocation of R&D efforts towards the “green” sector is required to efficiently achieve the transition goals.

Greenlighting the transition

These results provide important conceptual insights for the management of the transition to a green global economy. In particular, they suggest that, regardless of the pace of the transition, ensuring sufficient financing to promote R&D investments aimed at improving productivity in “green” sectors must be a top policy priority. Regarding capital investment, in the fast pathway the transition relies strongly on transfers from the “brown” sector before the “green” sector can grow endogenously. It also requires large and deep decarbonization of the “brown” sector. Ironically, this implies that a fast green transition depends on a “brown” sector which, during the early stages, is sufficiently robust to generate the needed resources and committed enough to reduce its emissions substantially. More generally, all transition pathways examined imply a substantial expansion of the green capital stock. Recent empirical research has shown that flows of green financing are still far from sufficient relative to estimated needs. Policy efforts hence need to focus on increasing flows of green financing to allow for the required buildups of capital stocks.

Follow the Topic

-

Communications Earth & Environment

An open access journal from Nature Portfolio that publishes high-quality research, reviews and commentary in the Earth, environmental and planetary sciences.

Related Collections

With Collections, you can get published faster and increase your visibility.

Holocene hydroclimate

Publishing Model: Hybrid

Deadline: Apr 30, 2026

Archaeology & Environment

Publishing Model: Hybrid

Deadline: Mar 31, 2026

Please sign in or register for FREE

If you are a registered user on Research Communities by Springer Nature, please sign in